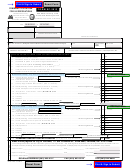

Form Nyc-1a - Combined Tax Return For Banking Corporations - 2017 Page 7

ADVERTISEMENT

Form NyC-1A - 2017

Page 7

- COMBINED GROUP INFORMATION SCHEDULE -

EIN OF PARENT CORPORATION:

NAME OF PARENT CORPORATION:

THE FOLLOwINg INFORMATION MusT bE PROvIDED FOR THIs RETuRN TO bE CONsIDERED COMPLETE

Refer to instructions before completing this section.

PART 1

general Information

A.

Does any member corporation pay rent greater than $200,000 for any premises

in NYC in the borough of Manhattan south of 96th Street for the purpose of

n

n

yEs

NO

carrying on any trade, business, profession, vocation or commercial activity?

b.

n

n

yEs

NO

If "YES," were all required Commercial Rent Tax Returns filed?

Attach schedule listing name of member corporation(s) and Employer

Identification Number(s) which was used on the Commercial Rent Tax Return(s).

1. a. Does this group include any corporations other than banking corporations or bank holding

companies required to file a combined return because they are taxpayers meeting the 80%

n

n

yEs

NO

or more stock ownership requirements of Administrative Code §11-646(f)(2)(i)?....................

b. If your answer to question (a) is “NO”, are any other banking corporations or bank holding

companies, whether or not taxpayers, that meet the stock ownership requirements of

n

n

Administrative Code §11-646(f)(2)(ii) NOT included in this return?..........................................

yEs

NO

c. have there been ANy CHANgEs in the COMPOsITION of the group of banking corporations

INCLuDED in this Combined Banking Corporation Tax Return from the PRIOR TAx PERIOD

OR ANy MATERIAL CHANgEs in the ACTIvITy of any member of the group or ANy

corporation NOT INCLuDED in the group that meets the stock ownership requirements for

n

n

yEs

NO

filing on a combined basis? (See instructions, page 1)...........................................................

d. Does the group include a captive real estate investment trust or captive regulated investment

company? (See “Captive Real Estate Investment Trusts (REITs) and Regulated Investment

n

n

yEs

NO

Companies (RICs)” in the instructions.) .................................................................................

n

2. Check this box

and attach an explanation if you meet ANy of the following conditions:

a. NO MEMbERs of this group FILED or REquEsTED AN ExTENsION to file a combined return under Article 32B of the

New York State Tax Law for the TAx PERIOD COvERED by THIs REPORT, OR

b. TwO (2) OR MORE MEMbERs of this group FILED or REquEsTED AN ExTENsION to file a New York State combined

return for the tax period covered by this report but there are differences in the membership of this group and the group

that filed or will file a New York State combined return, OR

c. A COMbINED FILINg by ANy MEMbER(s) of this group has been REvIsED or DIsALLOwED by New York State for

THIs or ANy PRIOR TAx PERIOD.

3. You MusT complete Part 2 of this schedule if you meet ANy of the following conditions:

a. This is the FIRsT Combined Banking Corporation Tax Return being FILED FOR THIs gROuP of corporations, or

b. There have been CHANgEs in the COMPOsITION of the group of corporations sINCE the PRIOR TAx PERIOD, IN-

CLuDINg CHANgEs As A REsuLT OF THE REquIREMENTs THAT ANy CORPORATION MusT usE wEIgHTED

FACTOR ALLOCATION IN THIs TAx PERIOD, OR

c. There have been ANy MATERIAL CHANgEs in the sTOCK OwNERsHIP or ACTIvITy of ANy corporation INCLuDED

in the group or in ANy corporation NOT INCLuDED in the group that meets the stock ownership requirements for filing

on a combined basis. (See instructions, page 1)

10171791

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8