Michigan Tax Amnesty And Tax Returns Guide And Instructons

ADVERTISEMENT

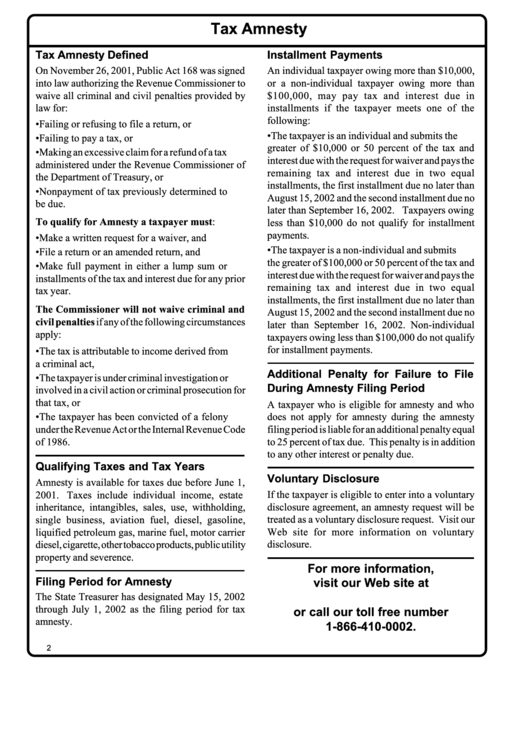

Tax Amnesty

Tax Amnesty Defined

Installment Payments

On November 26, 2001, Public Act 168 was signed

An individual taxpayer owing more than $10,000,

into law authorizing the Revenue Commissioner to

or a non-individual taxpayer owing more than

waive all criminal and civil penalties provided by

$100,000, may pay tax and interest due in

law for:

installments if the taxpayer meets one of the

following:

•

Failing or refusing to file a return, or

•

The taxpayer is an individual and submits the

•

Failing to pay a tax, or

greater of $10,000 or 50 percent of the tax and

•

Making an excessive claim for a refund of a tax

interest due with the request for waiver and pays the

administered under the Revenue Commissioner of

remaining tax and interest due in two equal

the Department of Treasury, or

installments, the first installment due no later than

•

Nonpayment of tax previously determined to

August 15, 2002 and the second installment due no

be due.

later than September 16, 2002. Taxpayers owing

To qualify for Amnesty a taxpayer must:

less than $10,000 do not qualify for installment

payments.

•

Make a written request for a waiver, and

•

The taxpayer is a non-individual and submits

•

File a return or an amended return, and

the greater of $100,000 or 50 percent of the tax and

•

Make full payment in either a lump sum or

interest due with the request for waiver and pays the

installments of the tax and interest due for any prior

remaining tax and interest due in two equal

tax year.

installments, the first installment due no later than

The Commissioner will not waive criminal and

August 15, 2002 and the second installment due no

civil penalties if any of the following circumstances

later than September 16, 2002. Non-individual

apply:

taxpayers owing less than $100,000 do not qualify

for installment payments.

•

The tax is attributable to income derived from

a criminal act,

Additional Penalty for Failure to File

•

The taxpayer is under criminal investigation or

During Amnesty Filing Period

involved in a civil action or criminal prosecution for

that tax, or

A taxpayer who is eligible for amnesty and who

•

The taxpayer has been convicted of a felony

does not apply for amnesty during the amnesty

under the Revenue Act or the Internal Revenue Code

filing period is liable for an additional penalty equal

of 1986.

to 25 percent of tax due. This penalty is in addition

to any other interest or penalty due.

Qualifying Taxes and Tax Years

Voluntary Disclosure

Amnesty is available for taxes due before June 1,

2001. Taxes include individual income, estate

If the taxpayer is eligible to enter into a voluntary

disclosure agreement, an amnesty request will be

inheritance, intangibles, sales, use, withholding,

treated as a voluntary disclosure request. Visit our

single business, aviation fuel, diesel, gasoline,

Web site for more information on voluntary

liquified petroleum gas, marine fuel, motor carrier

diesel, cigarette, other tobacco products, public utility

disclosure.

property and severence.

For more information,

Filing Period for Amnesty

visit our Web site at

The State Treasurer has designated May 15, 2002

through July 1, 2002 as the filing period for tax

or call our toll free number

amnesty.

1-866-410-0002.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41