Form Rv-2 Instructions - How To Complete Your Periodic Rental Motor Vehicle, Tour Vehicle, And Car-Sharing Vehicle Surcharge Tax Return Page 3

ADVERTISEMENT

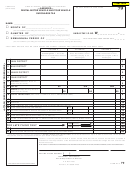

6 RATES

$0.25

$3

$15

$65

6

10

13

11

12

7 TAXES

(Multiply line 5 by

1,560

7

300 00

30

65

00

00

00

line 6 of Columns A through D)

14

8. TOTAL TAXES DUE.

Add line 7, Columns A through D and enter result here. If you did not have

1,955 00

8

any activity for the period, enter “0.00” here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

Amounts Assessed During the Period

PENALTY

9.

. . . . . . . . . . . . . . .

(For Amended Return ONLY)

9

16

INTEREST

1,955 00

10. TOTAL AMOUNT.

10

Add lines 8 and 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

11

TOTAL PAYMENTS MADE FOR THE PERIOD. (For Amended Return ONLY) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

12

CREDIT TO BE REFUNDED. Line 11 minus line 10 (For Amended Return ONLY) . . . . . . . . . . . . . . . . . . . . . . . . .

13.

13

ADDITIONAL TAXES DUE. Line 10 minus line 11 (For Amended Return ONLY). . . . . . . . . . . . . . . . . . . . . . . . . . .

20

PENALTY

FOR LATE FILING ONLY

14.

14

INTEREST

21

15.

TOTAL AMOUNT DUE AND PAYABLE. (Original Returns, add lines 10 and 14;

1,955 00

Amended Returns, add lines 13 and 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16.

AMOUNT OF YOUR PAYMENT

PLEASE ENTER THE

. Attach a check or money order payable to

“HAWAII STATE TAX COLLECTOR” in U.S. dollars drawn on any U.S. bank to Form RV-2. Write “RV”, the fi ling

22

period, your Hawaii Tax I.D. No., and your daytime phone number on your check or money order.

1,955 00

Mail to: HAWAII DEPARTMENT OF TAXATION, P. O. Box 2430, Honolulu, HI 96804-2430. If you are NOT submitting a

16

payment with this return, enter “0.00” here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

DECLARATION: I declare, under the penalties set forth in section 231-36, HRS, that this is a true and correct return, prepared in accordance with the

provisions of the Rental Motor Vehicle, Tour Vehicle, and Car-Sharing Vehicle Surcharge Tax Law and the rules issued thereunder.

23

IN THE CASE OF A CORPORATION OR PARTNERSHIP, THIS RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT.

Betty T. Kealoha

Owner

2/20/15

808 123-4567

(

)

SIGNATURE

TITLE

DATE

DAYTIME PHONE NUMBER

fig. 2.2

80

FORM RV-2

STEP 13 - In Column D, multiply the number entered on line

for payment, whether or not that first calendar day falls on

5 by the tax rate of $65 (line 6), and enter the result on line 7.

Saturday, Sunday, or legal holiday.

After computing the penalty and interest amounts, enter the

BTK has multiplied 1 (the number of tour vehicles in

results to the right of “PENALTY” and “INTEREST” and enter

use during the month on line 5) by $65 (the tax rate on

the total of the two amounts on line 14.

line 6) to get $65, which is entered in Column D, line 7

(1 x $65 = $65).

If you are unable to compute the penalty and interest, leave

these lines blank. The Department will compute the charges

FINISHING THE TAX RETURN (fig. 2.2)

for you and send you a bill.

STEP 21 - Add the amounts on lines 10 and 14, and enter

STEP 14 - Add Columns A through D of line 7, and enter the

the “TOTAL AMOUNT DUE AND PAYABLE” on line 15.

total on line 8. This is the total tax due. CAUTION: LINE 8

STEP 22 - NOTE: If you are NOT submitting a check with

MUST BE FILLED IN. If you do not have any RV tax activity

your return, enter “0.00” on line 16.

and therefore have no tax due, enter “0.00” on line 8.

Write the “AMOUNT OF YOUR PAYMENT”, including any

BTK has added $300, $1,560, $30, and $65 for a total

penalty and interest, on line 16. Attach your check or money

of $1,955 which is entered on line 8.

order for this amount payable to “Hawaii State Tax Collector”

STEP 15 - Leave line 9 blank (to be used for Amended

in U.S. dollars drawn on any U.S. bank where indicated on

Returns ONLY).

the return. Write “RV”, the filing period, your Hawaii Tax

I.D. No., and your daytime phone number on your check or

STEP 16 - Enter the amount from line 8 on line 10, “TOTAL

money order. DO NOT SEND CASH.

AMOUNT”.

STEP 17 - Leave line 11 blank (to be used for Amended

Send your check or money order and the return to:

Returns ONLY).

Hawaii Department of Taxation

STEP 18 - Leave line 12 blank (to be used for Amended

P. O. Box 2430

Returns ONLY).

Honolulu, HI 96804-2430

STEP 19 - Leave line 13 blank (to be used for Amended

STEP 23 - Sign your tax return. The sole proprietor, a

Returns ONLY).

partner or member, corporate officer, or an authorized agent

STEP 20 - Late Filing of Return - The penalty for failure to file

must sign and date the tax return, state his/her title, write

a return on time is assessed on the tax due at a rate of 5%

the date the return is signed, and write a daytime contact

per month, or part of a month, from the due date to the filing

phone number.

date, up to a maximum of 25%.

Interest - Interest at the rate of 2/3 of 1% per month, or part

of a month, shall be assessed on unpaid taxes and penalties

beginning with the first calendar day after the date prescribed

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4