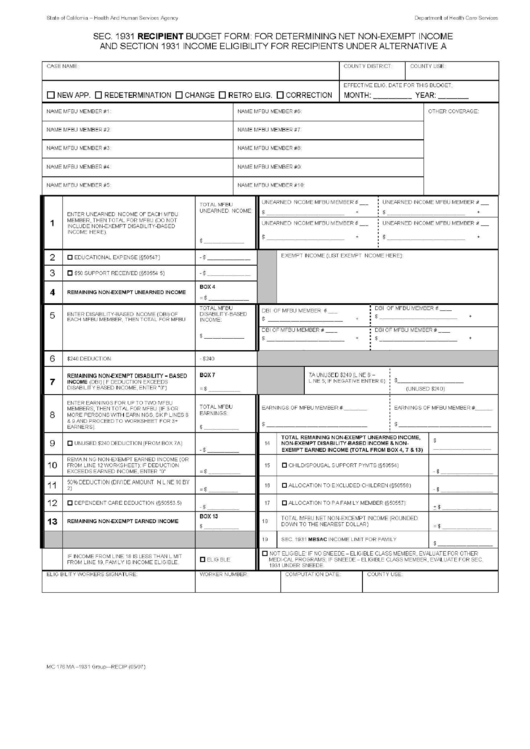

Form Mc 176 Ma - 1931 - Sec. 1931 Recipient Budget Form For Determining Net Non-Exempt Income And Section 1931 Income Eligibility For Recipients Under Alternative A

ADVERTISEMENT

CASE NAME

COU

NTY DISTR ICT

COU

NTY USE

EFFECT IVE

ELiG

. DATE FOR TH IS BUDGET:

D

NEWAPP.

D

REDETERMINATION

D

CHANGE

D

RETRO ELiG.

D

CORRECTION

MONTH:

-------

YEAR:

- - - - -

NAME

MFBU

MEMBER #1

NAME

MFBU

MEMBER #6

OTHER

CO

VERAGE

NAME

MFBU

MEMBER #2

NAME

MFBU

MEMBER #7

NAME

MFBU

MEMBER #3

NAME

MFBU

MEMBER #

8

NAME

MFBU

MEMBER #4

NAME

MFBU

MEMBER #9

NAME

MFBU

MEMBER #5

NAME MFBU MEMBER #10

UNEARNED

NCO

ME MFB

U

MEMBER

#

-

-

UNEARNED

INCO

ME

MFBU

MEMBER #

TOTAL

MFBU

-

UNEARNED

NCO

ME

ENTER UNEARNED

NCO

ME OF EACH MFB

U

$

- - - - - - - - - - - - -

:

$

- - - - - - - - - - - - -

1

MEMBER, THEN T OTAL FOR

MFBU (DO

NOT

.

UNEARNED

NCO

ME MFB

U

MEMBER #

UNEARNED

INCO

ME

MFBU

MEMBER #

INCLUDE NON-EXEMPT DISAB IL ITY-BASED

·

-

- - - - - -

.

·

-

:

-

INCO

ME HERE)

$

$

- - - - - - - - - - - - -

:

$

-

- - - - - - - - - - - -

2

o

EXEMPT

INCO

ME (LIST EXEMPT

NCO

ME HERE

)

EDUCAT

IO

NAL EXPENSE (§50547)

-$

- - - - - - -

3

o

$50 SU

PPORT RE CEIVED

(§

50554

5)

-$

- - - - - - -

BOX4

4

REMAINING NON-EXEMPT UNEARNED INCOME

0

$

- - - - - - -

TOTAL

MFBU

OBI

OF

MFBU

MEMBER #

5

ENTER DISAB ILITY-BASED

NCO

ME (OB

I)

OF

DISAB ILITY-BASED

- -

EACH

MFBU

MEMBER, THEN T OTAL FOR

MFBU

INCOME

$

- - - - - - - - - - - -

.

OB

I

OF MFB

U

MEMBER #

- -

·

OB

I

OF

MFBU

MEMBER #

- -

:

$

- - - - - - - - - - - - -

·

OB

I

OF

MFBU

MEMBER #

-

-

$

- - - - - -

$

$

- - - - - - - - - - - - -

- - - - - - - - - - - - -

.

6

$240

DEDUCT

IO

N

-

$240

REMAINING NON-EXEMPT DISABILITY - BASED

BOX7

7A UNUSED

$240

(L NE 6-

7

INCOME

(OB

I) (

F DEDUCT

IO

N

EXCEEDS

L NE 5: IF NEGAT IVE ENTER

0)

$

- - - - - - - - - - -

DISAB ILITY BASED

INCO

ME

,

ENTER

"0")

0$

- - - - - -

(UNUSED $24 0)

ENTER EARN ING

S

FOR UP T

O

TVYO

MFBU

TOTAL

MFBU

MEMBER

S,

THEN T OTAL FOR

MFBU

(IF 3 OR

EARN INGS OF

MFBU

MEMBER #

- - -

EARN ING

S

OF

MFBU

MEMBER #

8

- - -

EARN INGS

MORE PER

SO NS

W ITH EARN

NGS

, SK P

LINES 8

&

9 AND PR OCEED T

O

VYORK SHEET FOR

3+

$

$

EARNER

S)

$

- - - - - - - - - - - - - - - -

- - - - - - - - - - - - - -

- - - - -

TOTAL REMAINING NON-EXEMPT UNEARNED INCOME,

9

o

$

UNUSED

$240

DEDUCT

IO

N (FR OM

BOX

7A)

14

NON-EXEMPT DISABILITY-BASED INCOME & NON-

-$

EXEMPT EARNED INCOME (TOTAL FROM BOX 4, 7 & 13)

- - - - - - - - -

REMA N

NG

NON-EXEMPT EARNED INCOME

(O

R

10

FR OM

LI

NE 12WORKSHEET ): IF DED UCT

IO

N

15

o

CH

ILDISPOU

SAL

SU

PPORT PYMTS (§50554

)

EXCEEDS EARNED

INCO

ME, ENTER

"0"

0

$

- - - - -

-$

- - - - - - -

--

11

50% DEDUCT

IO

N (D IVIDE AM

OU

NT NLNE1

0

BY

16

A LLOCAT

IO

N

TO

EXCLUDED CHILDREN (§5

0558)

2

)

0

$

o

-$

12

o

DEPENDENT CARE DEDUCT

IO

N

(§50553 5)

17

o

ALL OCAT

IO

N

TO

PA FAM L Y MEMBER

(§

50557)

-$

'

$

BOX 13

13

T OTAL

MFBU

NET NON-EXCEMPT

INCO

ME

(ROU

NDED

REMAINING NON-EXEMPT EARNED INCOME

18

DOVvN

TO

THE NEAREST DOLLAR

)

$

- - - - -

0$

- - - - - - - - -

19

SEC. 1931

MBSAC INCO

ME LIMIT FOR FAM ILY

$

- - - - - - - - -

o

o

NOT ELI GIBLE IF

NO

SNEEDE- EL IGIBLE CLASS MEMBER, EVALUATE FOR OTHER

IF

INCO

ME FR OM

LI

NE

18 IS

LESS THAN L MIT

ELi

G BLE

MEDI-CAL PR

OG

RAMS: IF SNEEDE - EL IGIBLE CLASS MEMBER, EVALUATE FOR SEC

FR OM LINE 19

,

FAM L Y IS

INCO

ME

ELIGI

BLE

19 31 UNDER SNEEDE

ELiG BIL ITYWORKER

S SI

GNATURE

W ORKER NUMBER

I

CO

MPUTAT

IO

N DATE

I

COU

NTY USE

State of

Cali

fomia

-

Hea lth And Human

Servic

es Agency

Department of Health Care Services

SEC. 1931 RECIPIENT BUDGET FORM FOR DETERMINING NET NON-EXEMPT INCOME

AND SECTION 1931 INCOME ELIGIBILITY FOR RECIPIENTS UNDER ALTERNATIVE A

I

MC

176 MA

-

1931

Group-

RE CIP

(0 5/0

7)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1