Form Rts-1s - Report To Determine Succession And Application For Transfer Of Experience Rating Records Page 2

ADVERTISEMENT

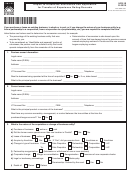

RTS-1S

R. 01/13

Page 2

4. Date of acquisition __________/__________/__________. Did you acquire all of the business?

Yes (Complete number 5(a) OR number 5(c) below, not both.)

No (Complete number 5(b) OR number 5(c) below, not both.)

5(a).

Total Succession (You have acquired 100% of the business and the predecessor has ceased payroll in Florida.)

In consideration of the transfer, the successor will be responsible for any indebtedness that is past due with respect to

wages paid by the predecessor prior to the date of succession. Any reemployment assistance benefits paid to former

employees of the predecessor will be charged to the successor employer and will be used in future tax rate calculations.

The successor employer does hereby request a transfer of the employment records from the account of the

predecessor employer. Upon receipt of a timely Form RTS-1S, the Department will compute your rate and notify you

by mail. You will then have 20 days to withdraw the application if you do not want the rate.

Successor signature: ___________________________________________________________ Date: _________________

Print name: _________________________________________ Title: ____________________________________________

5(b).

Partial Succession (You have acquired less than 100% of a business and the portion you acquired is an

identifiable and separate portion of the business you acquired.)

This portion of the form must be accompanied by the List of Employees to be Transferred (RTS-1SA, formerly

UCS-1SA) if you are transferring up to ten employees. If you are transferring more than ten employees, you must

send a list of employees to the Department electronically. For information on how to access the online system,

please call 800-352-3671.

The successor employer is liable for benefit charges paid to transferred employees for any claim based on wages

paid by the predecessor up to the date of succession.

The successor employer does hereby request a transfer of the employment records from the predecessor employer.

Upon receipt of a timely Form RTS-1S and Form RTS-1SA, the Department will compute your rate and notify you by

mail. You will then have 20 days to withdraw the application if you do not want the rate.

Successor signature: ___________________________________________________________ Date: _________________

Print name: _________________________________________ Title: ____________________________________________

To be completed by the predecessor employer:

Provide the date the employing unit being transferred first employed workers. This is not the acquisition

date, but is the date the unit was first reported by the predecessor(s): _____________________________

The predecessor employer hereby agrees to furnish such employment records pertaining to employment in

that portion of the business acquired by the successor employer and certifies that the form attached to the

application represents only employment in the portion of the business during the periods covered by the

forms. I understand that my future tax rate may be affected.

Predecessor signature: __________________________________________________________ Date: _________________

Print name: _________________________________________ Title: ____________________________________________

5(c).

Rejection of Transfer

The successor employer does hereby refuse a transfer of the employment records from the account of the

predecessor employer.

Successor signature: ___________________________________________________________ Date: _________________

Print name: _________________________________________ Title: ____________________________________________

Mail completed form to:

800-352-3671

Account Management

Florida Department of Revenue

PO Box 6510

Tallahassee FL 32314-6510

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2