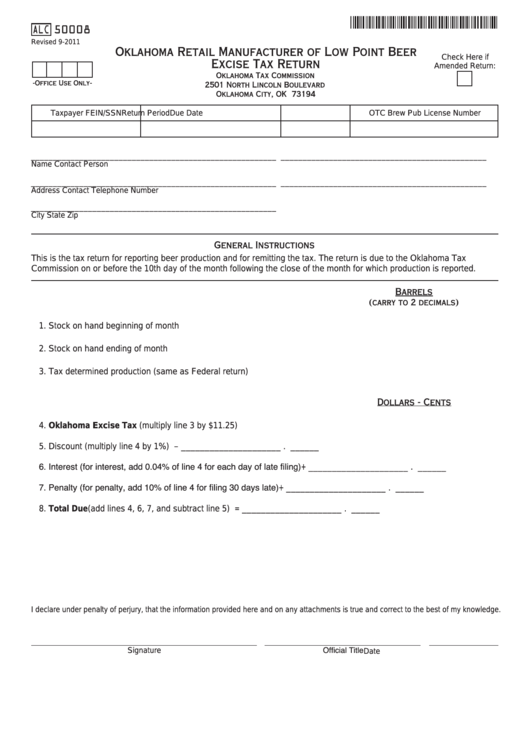

ALC 50008

Revised 9-2011

Oklahoma Retail Manufacturer of Low Point Beer

Check Here if

Excise Tax Return

Amended Return:

Oklahoma Tax Commission

-Office Use Only-

2501 North Lincoln Boulevard

Oklahoma City, OK 73194

Taxpayer FEIN/SSN

Return Period

Due Date

OTC Brew Pub License Number

________________________________________________________

_______________________________________________

Name

Contact Person

________________________________________________________

_______________________________________________

Address

Contact Telephone Number

________________________________________________________

City

State

Zip

General Instructions

This is the tax return for reporting beer production and for remitting the tax. The return is due to the Oklahoma Tax

Commission on or before the 10th day of the month following the close of the month for which production is reported.

Barrels

(carry to 2 decimals)

1. Stock on hand beginning of month .............................................................. _____________________________

2. Stock on hand ending of month ................................................................... _____________________________

3. Tax determined production (same as Federal return) .................................. _____________________________

Dollars - Cents

4. Oklahoma Excise Tax (multiply line 3 by $11.25) . ......................................X _____________________ . _ _____

5. Discount (multiply line 4 by 1%) . ..................................................................– _____________________ . _ _____

6. Interest (for interest, add 0.04% of line 4 for each day of late filing) . ...........+ _____________________ . _ _____

7. Penalty (for penalty, add 10% of line 4 for filing 30 days late) .....................+ _____________________ . _ _____

8. Total Due (add lines 4, 6, 7, and subtract line 5) . ........................................= _____________________ . _ _____

I declare under penalty of perjury, that the information provided here and on any attachments is true and correct to the best of my knowledge.

Official Title

Signature

Date

1

1 2

2