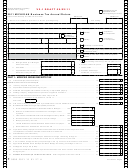

Form 4567 - Michigan Business Tax Annual Return - 2014 Page 2

ADVERTISEMENT

4567, Page 2

FEIN or TR Number

PART 2: BUSINESS INCOME TAX

28. Business Income. If negative, enter as a negative. (If business activity protected under PL 86-272,

complete and attach Form 4586 and/or 4581, as applicable; see instructions) ................................................

00

28.

Additions to Income

29. Interest income and dividends derived from obligations or securities of states other than Michigan .................

00

29.

30. Taxes on or measured by net income ................................................................................................................

00

30.

31. Tax imposed under MBT ....................................................................................................................................

00

31.

32. Any carryback or carryover of a federal net operating loss ................................................................................

00

32.

33. Losses attributable to other non-unitary flow-through entities that are taxed under the MBT.............................

00

33.

Account No.

34. Royalty, interest, and other expenses paid to a related person ..........................................................................

00

34.

00

35. Miscellaneous (see instructions) .......................................................................................................................

35.

36. Total Additions to Income. Add lines 29 through 35...........................................................................................

00

36.

37. Business Income Tax Base After Additions. Add lines 28 and 36. If negative, enter as a negative ...........

00

37.

Subtractions from Income

38. Dividends and royalties received from persons other than U.S. persons and foreign operating entities ..........

00

38.

39. Income attributable to other non-unitary flow-through entities that are taxed under the MBT ...........................

00

39.

Account No.

40. Interest income derived from United States obligations ....................................................................................

00

40.

41. Net earnings from self-employment. If less than zero, enter zero ....................................................................

00

41.

00

42. Miscellaneous (see instructions) .......................................................................................................................

42.

43. Total Subtractions from Income. Add lines 38 through 42 ................................................................................

00

43.

44. Business Income Tax Base. Subtract line 43 from line 37. If negative, enter as a negative ..................................

00

44.

45. Apportioned Business Income Tax Base. Multiply line 44 by percentage on line 11c .......................................

00

45.

46. Available MBT business loss carryforward from previous MBT return. Enter as a positive number..................

00

46.

47. Subtract line 46 from line 45. If negative, enter here as a negative, skip line 48, and enter zero on line 49. A

negative number here is the available business loss carryforward to the next MBT filing period (see instr.) .....

00

47.

48. Qualified Affordable Housing Deduction. If line 47 is positive, complete lines 48a through 48i as follows:

(1) If taking the QAHP deduction only, complete lines 48a through 48i. (UBGs, see instructions.) (2) If

taking the seller’s deduction only, skip lines 48a through 48h and carry the amount from Form 4579, line

5, to line 48i. (3) If taking both deductions, complete the QAHP deduction calculation on lines 48a through

48h, and add to the total at line 48i the amount from Form 4579, line 5.

a. Gross rental receipts attributable to residential units in

00

Michigan ........................................................................................... 48a.

b. Rental expenses attributable to residential rental units in Michigan ... 48b.

00

c. Taxable income attributable to residential rental units. Subtract line

48b from line 48a .............................................................................. 48c.

00

d. Number of residential rent restricted units in Michigan owned by

the Qualified Affordable Housing Project .......................................... 48d.

e. Total number of residential rental units in Michigan owned by the

Qualified Affordable Housing Project ................................................ 48e.

f. Divide line 48d by line 48e and enter as a percentage..................... 48f.

%

g. Multiply line 48c by line 48f............................................................... 48g.

00

h. Limited dividends or other distributions made to the owners of

the project ......................................................................................... 48h.

00

i. Qualified Affordable Housing Deduction. Subtract line 48h from line 48g. (See instructions.) ....................

00

48i.

49. Subtract line 48i from line 47. If less than zero, enter zero ...............................................................................

00

49.

50. Business Income Tax Before All Credits. Multiply line 49 by 4.95% (0.0495).......................................................

00

50.

+

Continue and sign on Page 3

0000 2014 11 02 27 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15