Form Mrt1 - Mortgage Registry Tax

Download a blank fillable Form Mrt1 - Mortgage Registry Tax in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Mrt1 - Mortgage Registry Tax with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

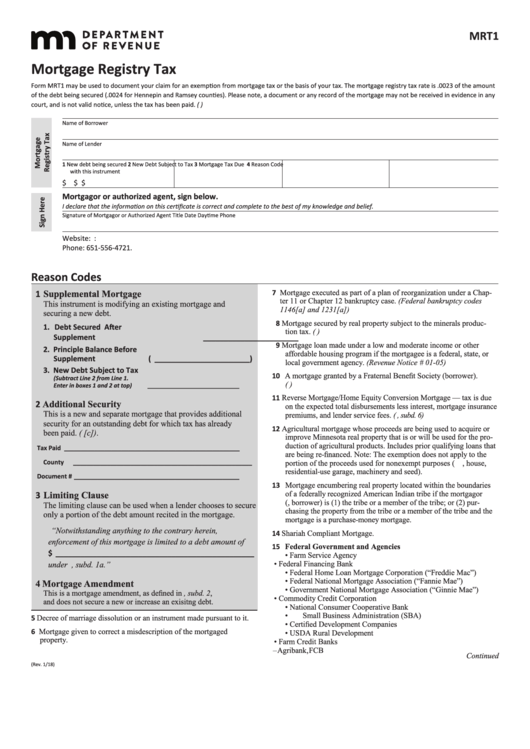

MRT1

Mortgage Registry Tax

Form MRT1 may be used to document your claim for an exemption from mortgage tax or the basis of your tax. The mortgage registry tax rate is .0023 of the amount

of the debt being secured (.0024 for Hennepin and Ramsey counties). Please note, a document or any record of the mortgage may not be received in evidence in any

court, and is not valid notice, unless the tax has been paid. (M.S. 287.10)

Name of Borrower

Name of Lender

1 New debt being secured

2 New Debt Subject to Tax

3 Mortgage Tax Due

4 Reason Code

with this instrument

$

$

$

Mortgagor or authorized agent, sign below.

I declare that the information on this certificate is correct and complete to the best of my knowledge and belief.

Signature of Mortgagor or Authorized Agent

Title

Date

Daytime Phone

Website: Email: MortgageDeed.Taxes@state.mn.us

Phone: 651-556-4721.

Reason Codes

1 Supplemental Mortgage

7 Mortgage executed as part of a plan of reorganization under a Chap-

ter 11 or Chapter 12 bankruptcy case. (Federal bankruptcy codes

This instrument is modifying an existing mortgage and

1146[a] and 1231[a])

securing a new debt.

8 Mortgage secured by real property subject to the minerals produc-

1. Debt Secured After

tion tax. (M.S. 298.24 to 298.28)

Supplement

_______________________

9 Mortgage loan made under a low and moderate income or other

2. Principle Balance Before

affordable housing program if the mortgagee is a federal, state, or

Supplement

( _______________________ )

local government agency. (Revenue Notice # 01-05)

3. New Debt Subject to Tax

10 A mortgage granted by a Fraternal Benefit Society (borrower).

(Subtract Line 2 from Line 1.

(M.S. 64B)

Enter in boxes 1 and 2 at top)

_____________________________

11 Reverse Mortgage/Home Equity Conversion Mortgage — tax is due

2 Additional Security

on the expected total disbursements less interest, mortgage insurance

This is a new and separate mortgage that provides additional

premiums, and lender service fees. (M.S. 287.05, subd. 6)

security for an outstanding debt for which tax has already

12 Agricultural mortgage whose proceeds are being used to acquire or

been paid. (M.S. 287.01.04[c]).

improve Minnesota real property that is or will be used for the pro-

duction of agricultural products. Includes prior qualifying loans that

Tax Paid ____________________________________________________

are being re-financed. Note: The exemption does not apply to the

County _____________________________________________________

portion of the proceeds used for nonexempt purposes (e.g., house,

residential-use garage, machinery and seed).

Document # _________________________________________________

13 Mortgage encumbering real property located within the boundaries

3 Limiting Clause

of a federally recognized American Indian tribe if the mortgagor

(i.e., borrower) is (1) the tribe or a member of the tribe; or (2) pur-

The limiting clause can be used when a lender chooses to secure

chasing the property from the tribe or a member of the tribe and the

only a portion of the debt amount recited in the mortgage.

mortgage is a purchase-money mortgage.

“Notwithstanding anything to the contrary herein,

14 Shariah Compliant Mortgage.

enforcement of this mortgage is limited to a debt amount of

15 Federal Government and Agencies

$ ________________________________________________

• Farm Service Agency

• Federal Financing Bank

under M.S. 287.05, subd. 1a.”

• Federal Home Loan Mortgage Corporation (“Freddie Mac”)

• Federal National Mortgage Association (“Fannie Mae”)

4 Mortgage Amendment

• Government National Mortgage Association (“Ginnie Mae”)

This is a mortgage amendment, as defined in M.S. 287.01, subd. 2,

• Commodity Credit Corporation

and does not secure a new or increase an exisitng debt.

• National Consumer Cooperative Bank

• U.S. Small Business Administration (SBA)

5 Decree of marriage dissolution or an instrument made pursuant to it.

• Certified Development Companies

6 Mortgage given to correct a misdescription of the mortgaged

• USDA Rural Development

property.

• Farm Credit Banks

– Agribank, FCB

Continued

(Rev. 1/18)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2