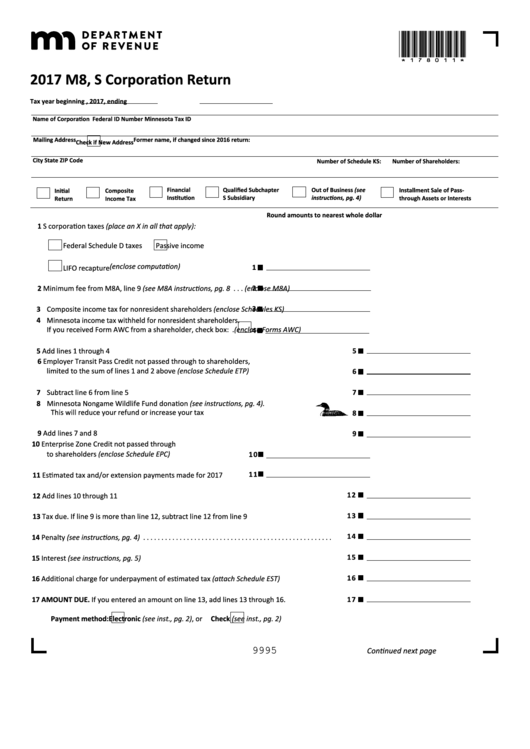

*178011*

2017 M8, S Corporation Return

Tax year beginning

, 2017, ending

Name of Corporation

Federal ID Number

Minnesota Tax ID

Mailing Address

Former name, if changed since 2016 return:

Check if New Address

City

State

ZIP Code

Number of Schedule KS:

Number of Shareholders:

Qualified Subchapter

Out of Business (see

Financial

Installment Sale of Pass-

Initial

Composite

Institution

S Subsidiary

instructions, pg. 4)

through Assets or Interests

Income Tax

Return

Round amounts to nearest whole dollar

1 S corporation taxes (place an X in all that apply):

Federal Schedule D taxes

Passive income

(enclose computation)

1

LIFO recapture . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Minimum fee from M8A, line 9 (see M8A instructions, pg. 8 . . .

2

(enclose M8A)

(enclose Schedules KS)

3 Composite income tax for nonresident shareholders . . . . . . . . .

3

4 Minnesota income tax withheld for nonresident shareholders.

(enclose Forms AWC)

If you received Form AWC from a shareholder, check box: .

4

5

5 Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Employer Transit Pass Credit not passed through to shareholders,

limited to the sum of lines 1 and 2 above (enclose Schedule ETP) . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7

7 Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Minnesota Nongame Wildlife Fund donation (see instructions, pg. 4).

This will reduce your refund or increase your tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Add lines 7 and 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Enterprise Zone Credit not passed through

to shareholders (enclose Schedule EPC) . . . . . . . . . . . . . . . . . . . . .

1 0

1 1

11 Estimated tax and/or extension payments made for 2017 . . . . .

1 2

12 Add lines 10 through 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 3

13 Tax due. If line 9 is more than line 12, subtract line 12 from line 9 . . . . . . . . . . . . . . . . . . . . . . .

1 4

14 Penalty (see instructions, pg. 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 5

15 Interest (see instructions, pg. 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 6

16 Additional charge for underpayment of estimated tax (attach Schedule EST) . . . . . . . . . . . . . . .

17 AMOUNT DUE. If you entered an amount on line 13, add lines 13 through 16. . . . . . . . . . . . . .

1 7

Payment method:

Electronic (see inst., pg. 2), or

Check (see inst., pg. 2)

9995

Continued next page

1

1 2

2 3

3