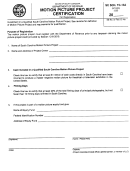

Form Sc Sch.tc-25 - Motion Picture Credits Page 2

ADVERTISEMENT

Information and Instructions For South Carolina Schedule TC-25

Who Must Complete the Form

Section 12-6-3510 which established the credits provided in TC-13 was repealed effective July 1, 2004. Section

12-6-3570 establishes the credits provided in TC-25 and became effective July 1, 2004.

Entities that invest after June 30, 2004 in a company that produces or develops a qualified South Carolina motion picture

project and/or a qualifed South Carolina motion picture production facility must complete TC-25. A "C" Corporation claims

the credit on its own behalf. A pass-through entity such as a partnership, "S" corporation, Limited Liability Company (LLC)

taxed as a partnership, or a motion picture equity fund (MPEF) must provide (generally by means of a Schedule K-1) to

each respective partner, "S" corporation shareholder, LLC member or MPEF investor its share of the credit. In a tiered

pass-through arrangement, the ultimate taxpayers (i.e. those who can use the credit, such as an individual taxpayer) will

eventually receive the information as the K-1s are passed down through the various tiers.

TC-25 is made up of three parts. Part I computes the credit(s) related to investment in a company that produces or

develops a Qualified South Carolina Motion Picture Project. Part II computes the credit for investment in a company that

constructs, converts or equips a South Carolina motion picture production and/or post-production facility. Part III

aggregates the credits in Parts I and II. Complete each applicable part. Any investor claiming a credit on this schedule

must complete Part III.

Qualified South Carolina Motion Picture Project

A person who invests cash in a company that develops or produces a qualified motion picture project may claim an

income tax credit of 20% of the cash invested. The credit is limited to $100,000. All cash invested must have been spent

for services performed in South Carolina, for tangible personal property dedicated to first use in South Carolina and/or for

real property located in South Carolina. A taxpayer may claim no more than one credit in connection with the production of

a single qualified South Carolina motion picture project. The credit is allowed over more than one taxable year, but the

total credit in all years is limited to $100,000 per project.

A "motion picture project" is a product intended for commercial exploitation that incurs at least $250,000 of costs directly in

this State to produce a master negative motion picture, whether film, tape, or other medium, for theatrical or television

exhibition in the United States and in which at least 20% of total filming days of principal photography, but not fewer than

10 filming days, is filmed in this State. Upon the recommendation of the South Carolina Film Commission, and if

appropriate, the Coordinating Council for Economic Development shall certify the motion picture project as a project

eligible for purposes of this article.

A "qualified South Carolina motion picture project" is a motion picture project which has registered by submitting its record

of allocation of credits and documentation to the Department of Revenue. Before registration, all documentation of a

motion picture project required to meet the credit requirements, must be received by the Department of Commerce.

South Carolina Motion Picture Production or Post-production Facility

A person who invests in a company that constructs, converts and/or equips a motion picture production or post-production

facility may claim a credit of 20% of the amount invested.

The total investment in South Carolina must be at least $2,000,000, not including land costs, in the case of a production

facility and $1,000,000 in the case of a post-production facility.

The amount invested includes cash and the fair market value of real property with any improvements thereon. Cash

invested must have been spent for services performed in South Carolina, tangible personal property dedicated to first use

in this South Carolina, or for real property located in this South Carolina. Real property invested must be real property

located in South Carolina on which facilities are located. Real property invested includes the fair market value of any lease

of real property with a term in excess of 36 months minus the fair market value of any consideration paid for the lease.

33882028

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3