Veterans Exemption Initial Application For 2018/2019 - New York Department Of Finance Page 5

ADVERTISEMENT

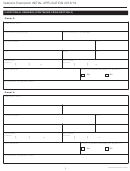

Veterans Exemption INITIAL APPLICATION 2018/19

2. OWNER(S) INFORMATION (CONTINUED)

Owner 1

NAME (FIRST, LAST)

DATE OF BIRTH (mm/dd/yyyy)

SOCIAL SECURITY / ITIN NUMBER

STREET ADDRESS

APT.

CITY

STATE

ZIP

TELEPHONE

CELL PHONE

NUMBER

NUMBER

(

)

–

(

)

–

n

n

IS THIS THE PRIMARY RESIDENCE OF OWNER 1?

EMAIL ADDRESS

Yes

No

Owner 2:

NAME (FIRST, LAST)

DATE OF BIRTH (mm/dd/yyyy)

SOCIAL SECURITY / ITIN NUMBER

STREET ADDRESS

APT.

CITY

STATE

ZIP

TELEPHONE

CELL PHONE

NUMBER

NUMBER

(

)

–

(

)

–

n

n

IS THIS THE PRIMARY RESIDENCE OF OWNER 2?

EMAIL ADDRESS

Yes

No

n

n

ARE OWNERS 1 AND 2

Yes

No

MARRIED TO EACH OTHER?

The Federal Privacy Act of 1974, as amended, requires agencies requesting Social Security Numbers to inform individuals from whom they seek this information as to whether compliance with the request

is voluntary or mandatory, why the request is being made and how the information will be used. The disclosure of Social Security Numbers for applicants and income-earning occupants is mandatory and

is required by section 11-102.1 of the Administrative Code of the City of New York. Such numbers disclosed on any reports or returns are requested for tax administration purposes and will be used to facilitate

the processing of reports and to establish and maintain a uniform system for identifying taxpayers who are or may be subject to taxes administered and collected by the Department of Finance. Such numbers

may also be disclosed as part of information contained in the taxpayer’s return to another department, person, agency or entity as may be required by law, or if the applicant or income-earning occupants

give written authorization to the Department of Finance.

Veterans Exemption Rev. 12/4/17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8