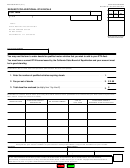

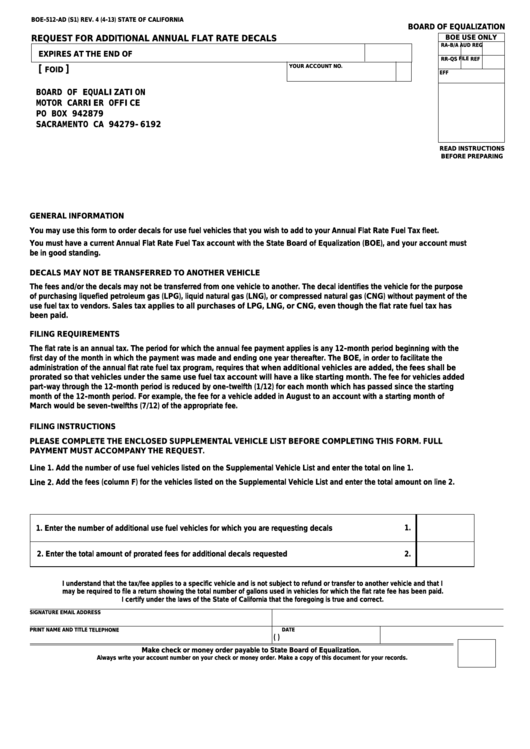

BOE-512-AD (S1) REV. 4 (4-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

REQUEST FOR ADDITIONAL ANNUAL FLAT RATE DECALS

BOE USE ONLY

RA-B/A

AUD

REG

EXPIRES AT THE END OF

RR-QS

FILE

REF

YOUR ACCOUNT NO.

[

]

FOID

EFF

BOARD OF EQUALIZATION

MOTOR CARRIER OFFICE

PO BOX 942879

SACRAMENTO CA 94279-6192

READ INSTRUCTIONS

BEFORE PREPARING

GENERAL INFORMATION

You may use this form to order decals for use fuel vehicles that you wish to add to your Annual Flat Rate Fuel Tax fleet.

You must have a current Annual Flat Rate Fuel Tax account with the State Board of Equalization (BOE), and your account must

be in good standing.

DECALS MAY NOT BE TRANSFERRED TO ANOTHER VEHICLE

The fees and/or the decals may not be transferred from one vehicle to another. The decal identifies the vehicle for the purpose

of purchasing liquefied petroleum gas (LPG), liquid natural gas (LNG), or compressed natural gas (CNG) without payment of the

use fuel tax to vendors. Sales tax applies to all purchases of LPG, LNG, or CNG, even though the flat rate fuel tax has

been paid.

FILING REQUIREMENTS

The flat rate is an annual tax. The period for which the annual fee payment applies is any 12-month period beginning with the

first day of the month in which the payment was made and ending one year thereafter. The BOE, in order to facilitate the

administration of the annual flat rate fuel tax program, requires that when additional vehicles are added, the fees shall be

prorated so that vehicles under the same use fuel tax account will have a like starting month. The fee for vehicles added

part-way through the 12-month period is reduced by one-twelfth (1/12) for each month which has passed since the starting

month of the 12-month period. For example, the fee for a vehicle added in August to an account with a starting month of

March would be seven-twelfths (7/12) of the appropriate fee.

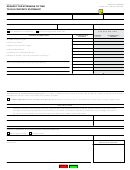

FILING INSTRUCTIONS

PLEASE COMPLETE THE ENCLOSED SUPPLEMENTAL VEHICLE LIST BEFORE COMPLETING THIS FORM. FULL

PAYMENT MUST ACCOMPANY THE REQUEST.

Line 1. Add the number of use fuel vehicles listed on the Supplemental Vehicle List and enter the total on line 1.

Line 2. Add the fees (column F) for the vehicles listed on the Supplemental Vehicle List and enter the total amount on line 2.

1.

1. Enter the number of additional use fuel vehicles for which you are requesting decals

2. Enter the total amount of prorated fees for additional decals requested

2.

I understand that the tax/fee applies to a specific vehicle and is not subject to refund or transfer to another vehicle and that I

may be required to file a return showing the total number of gallons used in vehicles for which the flat rate fee has been paid.

I certify under the laws of the State of California that the foregoing is true and correct.

SIGNATURE

EMAIL ADDRESS

PRINT NAME AND TITLE

TELEPHONE

DATE

(

)

Make check or money order payable to State Board of Equalization.

Always write your account number on your check or money order. Make a copy of this document for your records.

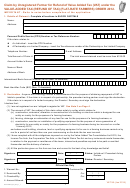

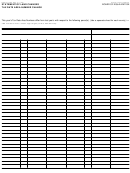

CONTINUE

1

1 2

2 3

3