BOE-512-AD (S2B) REV. 4 (4-13)

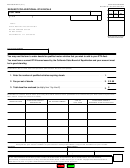

INSTRUCTIONS FOR SUPPLEMENTAL VEHICLE LIST

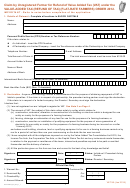

Payments: You can make your payment by paper check, Online ACH Debit (ePay) or by credit card. To use ePay, go to our

website at , click on the eServices tab and log in to make a payment. To pay by credit card, go to our

website or call 1-855-292-8931. Mandatory EFT accounts must pay by EFT or ePay. Be sure to sign and mail your return.

Please complete the Supplemental Vehicle List as shown in the example below. You may print or type the required information.

FEE SCHEDULE EXAMPLE

A

B

C

D

E

F

BOE USE ONLY

MAKE

YEAR

LICENSE NUMBER

UNLADEN

TYPE OF

FEE

(Decal Number)

WEIGHT

FUEL

--

Plymouth

64

SAM123

LPG

$

21.00

Chevrolet

72

Z73700

8220

CNG

$

70.00

Ford

78

00737A

6072

LPG

$

42.00

Winnebago

--

LNG

89

2SAM123

$

21.00

$

154.00

TOTAL FEES ENCLOSED

Indicate the make of vehicle for which you are applying for an Annual Flat Rate Decal.

Column A.

Indicate the year of the vehicle for which you are applying for an Annual Flat Rate Decal.

Column B.

Indicate the license number of the vehicle for which you are applying for the Annual Flat Rate Decal.

Column C.

Does not apply to vehicles with automobile license plates. Fees for all vehicles with commercial plates and

Column D.

subject to weight fees are determined by the unladen weight of the vehicle, which must agree with the

unladen weight shown on the vehicle registration card or ownership certificate.

Use initials for fuel type: Liquefied Petroleum Gas - LPG

Column E.

Liquid Natural Gas

- LNG

Compressed Natural Gas - CNG

The fee schedule is based upon unladen weight of vehicles which are subject to weight fees. To calculate

Column F.

the fee due on each additional vehicle, please complete the following formula:

Reduce the fee by one-twelfth (1/12) for each month which has passed since the starting month

of the 12-month period and enter the result in column F.

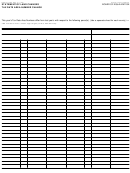

Total the vehicles by type. Transfer the total number of vehicles to line 1 on the front of the request. Enter the total

amount of fees enclosed on line 2 on the front of the request.

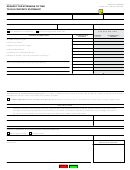

FEE SCHEDULE

FEE

TYPES OF VEHICLES AND FEES SCHEDULE

VEHICLES WITH AUTOMOBILE LICENSE PLATES

$

36.00

Passenger vehicles and other vehicles with automobile plates

VEHICLES WITH COMMERCIAL PLATES (UNLADEN WEIGHT)

36.00

4,000 lbs. or less

$

72.00

More than 4,000 lbs. but less than 8,001 lbs.

$

More than 8,000 lbs. but less than 12,001 lbs.

120.00

$

168.00

More than 12,000 lbs.

$

If you need additional information, please contact the State Board of Equalization, Motor Carrier Office, P.O. Box 942879,

Sacramento, CA 94279-0065. You may also visit the BOE website at or call the Taxpayer Information Section at

1-800-400-7115 (TTY:711); from the main menu, select the option Special Taxes and Fees.

1

1 2

2 3

3