Form Wv/sev-401t - Annual Timber Severance Tax Return Page 2

ADVERTISEMENT

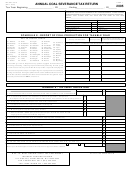

WV/SEV-401T

ANNUAL TIMBER SEVERANCE TAX RETURN

rtL100V.6-Web

SCHEDULE A: Enter the Amount of Timber Harvested and the Income Attributable for the Taxable Year

Quantity*

Gross Proceeds of Sale (Dollar Value)

00

1.

Sawed Timber (Board Feet)

.

.

00

2.

Pulp Wood Harvested (Tons)

.

.

00

3.

Other (specify)

.

.

* For Sawed Timber, provide the number of Board Feet of timber harvested. For Pulpwood, provide the number of Tons of pulpwood harvested.

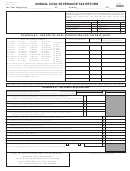

SCHEDULE TC - TAX CREDITS

1.

Annual Credit - $500 per year or $41.67 per month for each month engaged in business in West Virginia

.

2.

Manufacturing Investment Tax Credit

.

3.

Credit for Industrial Expansion and/or Revitalization

.

4.

Credit for Research and Development Projects

.

Credit for Business Investment and Jobs Expansion, Corporate Headquarters

5.

.

Relocation and Small Business Investment and Jobs Expansion

6.

West Virginia Capital Company Credit

.

7. Total Credit - Add lines 1 through 6 and Enter here and Line 6 on Page 1

.

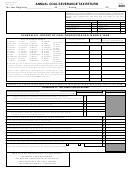

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the

best of my knowledge and belief it is true, and complete.

(Signature of Taxpayer)

(Name of Taxpayer - Type or Print)

(Title)

(Date)

(Person to Contact Concerning this Return)

(Telephone Number)

(Signature of preparer other than taxpayer)

(Address)

(Date)

G

1

0

2

0

0

8

0

2

W

PAGE 2 OF 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2