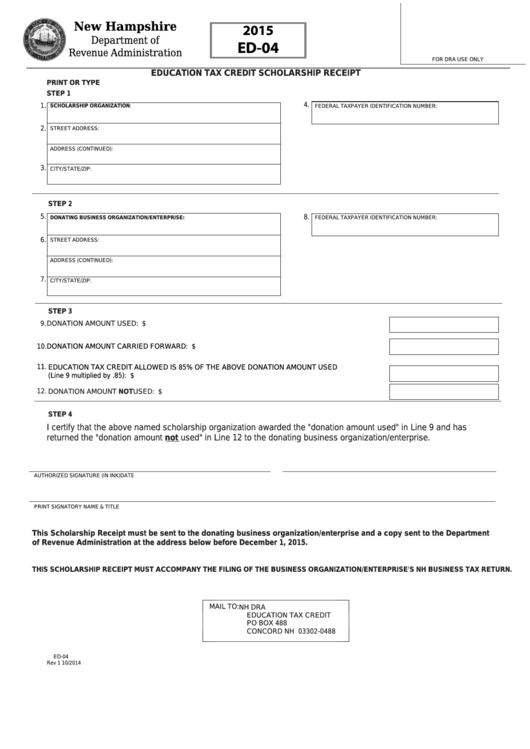

New Hampshire

2015

Department of

ED-04

Revenue Administration

FOR DRA USE ONLY

EDUCATION TAX CREDIT SCHOLARSHIP RECEIPT

PRINT OR TYPE

STEP 1

4.

1.

SCHOLARSHIP ORGANIZATION:

FEDERAL TAXPAYER IDENTIFICATION NUMBER:

2.

STREET ADDRESS:

ADDRESS (CONTINUED):

3.

CITY/STATE/ZIP:

STEP 2

5.

8.

DONATING BUSINESS ORGANIZATION/ENTERPRISE:

FEDERAL TAXPAYER IDENTIFICATION NUMBER:

6.

STREET ADDRESS:

ADDRESS (CONTINUED):

7.

CITY/STATE/ZIP:

STEP 3

DONATION AMOUNT USED: ............................................................................................................................. $

9.

10.

DONATION AMOUNT CARRIED FORWARD: ................................................................................................... $

11.

EDUCATION TAX CREDIT ALLOWED IS 85% OF THE ABOVE DONATION AMOUNT USED

(Line 9 multiplied by .85): .................................................................................................................................... $

12.

DONATION AMOUNT NOT USED: .................................................................................................................... $

STEP 4

I certify that the above named scholarship organization awarded the "donation amount used" in Line 9 and has

returned the "donation amount not used" in Line 12 to the donating business organization/enterprise.

AUTHORIZED SIGNATURE (IN INK)

DATE

PRINT SIGNATORY NAME & TITLE

This Scholarship Receipt must be sent to the donating business organization/enterprise and a copy sent to the Department

of Revenue Administration at the address below before December 1, 2015.

THIS SCHOLARSHIP RECEIPT MUST ACCOMPANY THE FILING OF THE BUSINESS ORGANIZATION/ENTERPRISE'S NH BUSINESS TAX RETURN.

MAIL TO:

NH DRA

EDUCATION TAX CREDIT

PO BOX 488

CONCORD NH 03302-0488

ED-04

Rev 1 10/2014

1

1 2

2