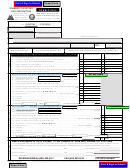

New Hampshire

2013

Department of

ED-04

Revenue Administration

EDUCATION TAX CREDIT SCHOLARSHIP RECEIPT INSTRUCTIONS

WHO MUST FILE?

LINE-BY-LINE INSTRUCTIONS CONTINUED

Scholarship organizations who received donations under

STEP 2

RSA 77-G must send an Education Tax Credit Scholarship

Receipt (Form ED-04) to each business organization or

LINE 5 Enter the business organization's or business

business enterprise who made a donation and the

enterprise's name who made a donation.

Department of Revenue Administration. This receipt will

LINE 6 Enter the business organization's or business

show the donor exactly how much of their donation was

enterprise's street address.

used. 85% of the donation used may be applied as a tax

credit against the business organization or business

LINE 7 Enter the business organization's or business

enterprise's New Hampshire business tax liability for the tax

enterprise's city, state and zip code.

year in which the donation was made.

LINE 8 Enter the business organization's or business

enterprise's Federal Taxpayer Identification Number.

WHEN TO FILE?

Form ED-04 must be sent to the donating business

organization/enterprise and a copy to the Department of

Revenue Administration by December 1, 2015.

STEP 3

WHERE TO FILE?

LINE 9 Enter the donation amount used from a business

Form ED-04 may be mailed to:

organization or business enterprise.

NH DRA

LINE 10 Enter the donation amount carried forward.

Education Tax Credit

PO Box 488

LINE 11 Enter 85% of the donation amount used by

Concord, NH 03302-0488

multiplying Line 9 by .85.

Or may be hand-delivered to the Department of Revenue

LINE 12 Enter the amount of the donation from the

Administration during business hours (Monday through

business organization or business enterprise that was not

Friday, 8:00 a.m. to 4:30 p.m.) at:

used.

Governor Hugh J. Gallen Office Park South

109 Pleasant Street

STEP 4

Medical and Surgical Building

Concord, NH

By signing this receipt, you are certifying that the donation

amount used was expended properly by the scholarship

organization and that the scholarship organization returned

NEED HELP?

the unused donation or portion thereof to the business

Call the Education Tax Credit Line at (603) 230-5018.

organization or business enterprise. The application must

For more information visit us on the web at:

be dated and signed in ink by the officer or authorized

Hearing or speech impaired

agent. In addition, print the name and title of the officer or

individuals may call TDD Access: Relay NH 1-800-735-2964.

authorized agent signing the application.

LINE-BY-LINE INSTRUCTIONS

NOTICE

In order for the donating business organization/

STEP 1

enterprise to take the tax credit available, this

scholarship receipt must be attached to the donating

LINE 1 Enter the scholarship organization's name.

business organization/enterprise's tax return when

filed with the Department.

LINE 2 Enter the scholarship organization's street address.

LINE 3 Enter the scholarship organization's city, state and

zip code.

LINE 4 Enter the scholarship organization's Federal

Taxpayer Identification Number.

ED-04-Instructions

Rev 1 10/2014

1

1 2

2