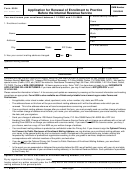

Form 8554-Ep - Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service As An Enrolled Retirement Plan Agent (Erpa) Page 2

ADVERTISEMENT

2

Form 8554-EP (Rev. 12-2014)

Page

5

Yes

No

Do you have a Centralized Authorization File (CAF) number?

If Yes, enter all CAF numbers assigned to you (attach additional pages, if necessary):

6

Do you have an Employer Identification Number (EIN)?

Yes

No

If Yes, enter all EINs, business names, and addresses below (attach additional pages, if necessary):

EIN

Business Name

Business Address

6a

6b

6c

Since you have become an ERPA Agent or your last renewal of enrollment (whichever is later):

7

Have you been sanctioned by a federal or state licensing authority?

Yes

No

Has any application you filed with a court, government department,

8

commission, or agency for admission to practice ever been denied?

Yes

No

9

Yes

No

Have you been convicted of a tax crime or any felony?

Have you been permanently enjoined from preparing tax returns, or

10

representing other before the IRS?

Yes

No

NOTE: If you answered yes to question 7, 8, 9 or 10, please describe on a separate page, the matter, including the date of

when the matter occurred, and provide any additional information about the matter that you would like us to consider.

11

Are you a CPA?

If Yes, enter the states where you are licensed to practice.

Yes

No

12

Are you an Attorney?

If Yes, enter the States where you are licensed to practice.

Yes

No

13

Are you an Enrolled Agent (EA)?

Yes

No

Part 3. Sign here

Under penalties of perjury, I declare that I have examined this application, and to the best of my knowledge and belief, it is true, correct, and complete.

PTIN

If you do not have a PTIN please check this box.

Signature

Date

8554-EP

Form

(Rev. 12-2014)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3