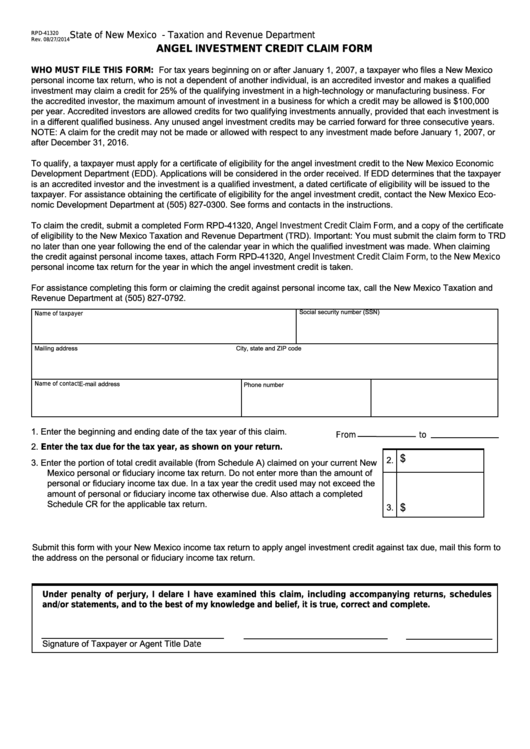

State of New Mexico - Taxation and Revenue Department

RPD-41320

Rev. 08/27/2014

ANGEL INVESTMENT CREDIT CLAIM FORM

WHO MUST FILE THIS FORM: For tax years beginning on or after January 1, 2007, a taxpayer who files a New Mexico

personal income tax return, who is not a dependent of another individual, is an accredited investor and makes a qualified

investment may claim a credit for 25% of the qualifying investment in a high-technology or manufacturing business. For

the accredited investor, the maximum amount of investment in a business for which a credit may be allowed is $100,000

per year. Accredited investors are allowed credits for two qualifying investments annually, provided that each investment is

in a different qualified business. Any unused angel investment credits may be carried forward for three consecutive years.

NOTE: A claim for the credit may not be made or allowed with respect to any investment made before January 1, 2007, or

after December 31, 2016.

To qualify, a taxpayer must apply for a certificate of eligibility for the angel investment credit to the New Mexico Economic

Development Department (EDD). Applications will be considered in the order received. If EDD determines that the taxpayer

is an accredited investor and the investment is a qualified investment, a dated certificate of eligibility will be issued to the

taxpayer. For assistance obtaining the certificate of eligibility for the angel investment credit, contact the New Mexico Eco-

nomic Development Department at (505) 827-0300. See forms and contacts in the instructions.

To claim the credit, submit a completed Form RPD-41320, Angel Investment Credit Claim Form, and a copy of the certificate

of eligibility to the New Mexico Taxation and Revenue Department (TRD). Important: You must submit the claim form to TRD

no later than one year following the end of the calendar year in which the qualified investment was made. When claiming

the credit against personal income taxes, attach Form RPD-41320, Angel Investment Credit Claim Form, to the New Mexico

personal income tax return for the year in which the angel investment credit is taken.

For assistance completing this form or claiming the credit against personal income tax, call the New Mexico Taxation and

Revenue Department at (505) 827-0792.

Social security number (SSN)

Name of taxpayer

Mailing address

City, state and ZIP code

Name of contact

E-mail address

Phone number

1. Enter the beginning and ending date of the tax year of this claim.

From

to

2. Enter the tax due for the tax year, as shown on your return.

$

2.

3. Enter the portion of total credit available (from Schedule A) claimed on your current New

Mexico personal or fiduciary income tax return. Do not enter more than the amount of

personal or fiduciary income tax due. In a tax year the credit used may not exceed the

amount of personal or fiduciary income tax otherwise due. Also attach a completed

Schedule CR for the applicable tax return.

$

3.

Submit this form with your New Mexico income tax return to apply angel investment credit against tax due, mail this form to

the address on the personal or fiduciary income tax return.

Under penalty of perjury, I delare I have examined this claim, including accompanying returns, schedules

and/or statements, and to the best of my knowledge and belief, it is true, correct and complete.

Signature of Taxpayer or Agent

Title

Date

1

1 2

2 3

3 4

4