Rpd-41304 New Mexico Filmmaker Tax Credit Claim Form

ADVERTISEMENT

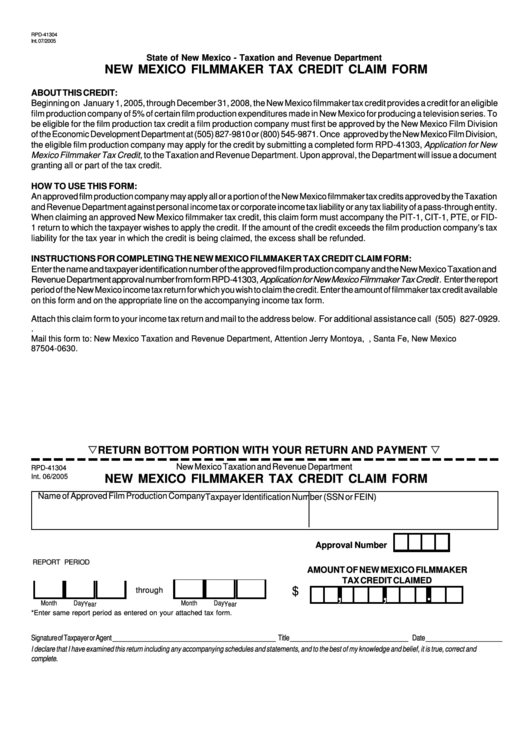

RPD-41304

Int. 07/2005

State of New Mexico - Taxation and Revenue Department

NEW MEXICO FILMMAKER TAX CREDIT CLAIM FORM

ABOUT THIS CREDIT:

Beginning on January 1, 2005, through December 31, 2008, the New Mexico filmmaker tax credit provides a credit for an eligible

film production company of 5% of certain film production expenditures made in New Mexico for producing a television series. To

be eligible for the film production tax credit a film production company must first be approved by the New Mexico Film Division

of the Economic Development Department at (505) 827-9810 or (800) 545-9871. Once approved by the New Mexico Film Division,

the eligible film production company may apply for the credit by submitting a completed form RPD-41303, Application for New

Mexico Filmmaker Tax Credit, to the Taxation and Revenue Department. Upon approval, the Department will issue a document

granting all or part of the tax credit.

HOW TO USE THIS FORM:

An approved film production company may apply all or a portion of the New Mexico filmmaker tax credits approved by the Taxation

and Revenue Department against personal income tax or corporate income tax liability or any tax liability of a pass-through entity.

When claiming an approved New Mexico filmmaker tax credit, this claim form must accompany the PIT-1, CIT-1, PTE, or FID-

1 return to which the taxpayer wishes to apply the credit. If the amount of the credit exceeds the film production company's tax

liability for the tax year in which the credit is being claimed, the excess shall be refunded.

INSTRUCTIONS FOR COMPLETING THE NEW MEXICO FILMMAKER TAX CREDIT CLAIM FORM:

Enter the name and taxpayer identification number of the approved film production company and the New Mexico Taxation and

Revenue Department approval number from form RPD-41303, Application for New Mexico Filmmaker Tax Credit . Enter the report

period of the New Mexico income tax return for which you wish to claim the credit. Enter the amount of filmmaker tax credit available

on this form and on the appropriate line on the accompanying income tax form.

Attach this claim form to your income tax return and mail to the address below. For additional assistance call (505) 827-0929.

.

Mail this form to: New Mexico Taxation and Revenue Department, Attention Jerry Montoya, P.O. Box 630, Santa Fe, New Mexico

87504-0630.

RETURN BOTTOM PORTION WITH YOUR RETURN AND PAYMENT

New Mexico Taxation and Revenue Department

RPD-41304

Int. 06/2005

NEW MEXICO FILMMAKER TAX CREDIT CLAIM FORM

Name of Approved Film Production Company

Taxpayer Identification Number (SSN or FEIN)

Approval Number

REPORT PERIOD

AMOUNT OF NEW MEXICO FILMMAKER

TAX CREDIT CLAIMED

.

,

,

$

through

Month

Day

Month

Day

Year

Year

*Enter same report period as entered on your attached tax form.

Signature of Taxpayer or Agent _______________________________________________ Title __________________________________ Date ______________________

I declare that I have examined this return including any accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and

complete.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1