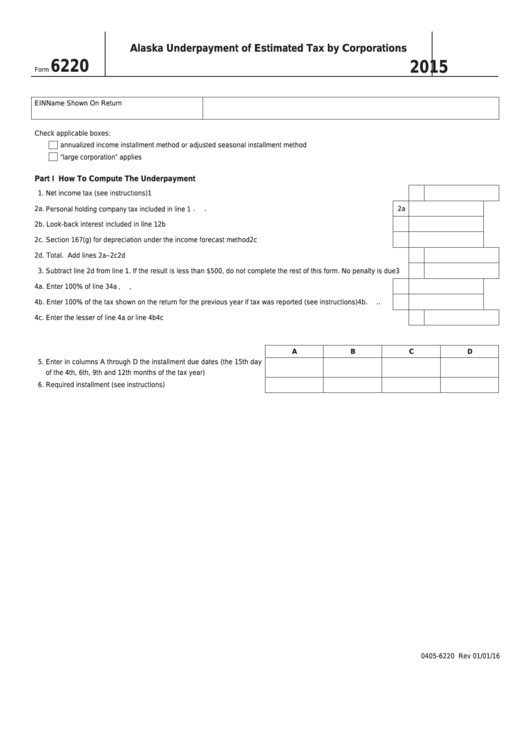

Form 6220 - Alaska Underpayment Of Estimated Tax By Corporations - 2015

ADVERTISEMENT

Alaska Underpayment of Estimated Tax by Corporations

6220

2015

Form

EIN

Name Shown On Return

Check applicable boxes:

annualized income installment method or adjusted seasonal installment method

“large corporation” applies

Part I How To Compute The Underpayment

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1. Net income tax (see instructions)

1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2a. Personal holding company tax included in line 1

2a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2b. Look-back interest included in line 1

2b

.

.

.

.

.

.

.

.

.

.

.

.

.

2c. Section 167(g) for depreciation under the income forecast method

2c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2d. Total. Add lines 2a–2c

2d

.

3. Subtract line 2d from line 1. If the result is less than $500, do not complete the rest of this form. No penalty is due

3

4a. Enter 100% of line 3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4a

.

.

.

4b. Enter 100% of the tax shown on the return for the previous year if tax was reported (see instructions)

4b

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4c. Enter the lesser of line 4a or line 4b

4c

A

B

C

D

5. Enter in columns A through D the installment due dates (the 15th day

.

.

.

.

.

.

of the 4th, 6th, 9th and 12th months of the tax year)

.

.

.

.

.

.

.

.

.

6. Required installment (see instructions)

0405-6220 Rev 01/01/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1