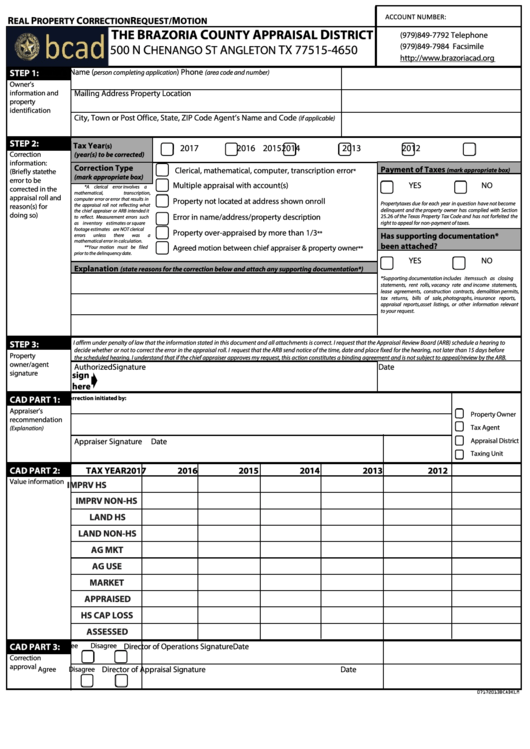

ACCOUNT NUMBER:

R

P

C

R

M

EAL

ROPERTY

ORRECTION

EQUEST/

OTION

T

B

C

A

D

HE

RAZORIA

OUNTY

PPRAISAL

ISTRICT

(979) 849-7792 Telephone

(979) 849-7984 Facsimile

500 N C

S

A

TX 77515-4650

HENANGO

T

NGLETON

STEP 1:

Owner’s Name (

)

Phone

person completing application

(area code and number)

Owner’s

information and

Mailing Address

Property Location

property

identification

City, Town or Post Office, State, ZIP Code

Agent’s Name and Code

(if applicable)

STEP 2:

Tax Year

(s)

2017

2016

2015

2014

2013

2012

Correction

(year(s) to be corrected)

information:

Correction Type

Payment of Taxes

Clerical, mathematical, computer, transcription error

(mark appropriate box)

(Briefly state the

*

(mark appropriate box)

error to be

Multiple appraisal with account(s)

YES

NO

*A clerical error involves a

corrected in the

mathematical,

transcription,

appraisal roll and

computer error or error that results in

Property not located at address shown on roll

Property taxes due for each year in question have not become

reason(s) for

the appraisal roll not reflecting what

delinquent and the property owner has complied with Section

the chief appraiser or ARB intended it

doing so)

Error in name/address/property description

25.26 of the Texas Property Tax Code and has not forfeited the

to reflect. Measurement errors such

right to appeal for non-payment of taxes.

as inventory estimates or square

footage estimates are NOT clerical

Property over-appraised by more than 1/3

**

Has supporting documentation*

errors

unless

there

was

a

mathematical error in calculation.

been attached?

Agreed motion between chief appraiser & property owner

**Your motion must be filed

**

prior to the delinquency date.

YES

NO

Explanation

(state reasons for the correction below and attach any supporting documentation*)

*Supporting documentation includes items such as closing

statements, rent rolls, vacancy rate and income statements,

lease agreements, construction contracts, demolition permits,

tax returns, bills of sale, photographs, insurance reports,

appraisal reports, asset listings, or other information relevant

to your request.

STEP 3:

I affirm under penalty of law that the information stated in this document and all attachments is correct. I request that the Appraisal Review Board (ARB) schedule a hearing to

decide whether or not to correct the error in the appraisal roll. I request that the ARB send notice of the time, date and place fixed for the hearing, not later than 15 days before

Property

the scheduled hearing. I understand that if the chief appraiser approves my request, this action constitutes a binding agreement and is not subject to appeal/review by the ARB.

owner/agent

Authorized Signature

Date

signature

sign

here

CAD PART 1:

Correction initiated by:

Appraiser’s

Property Owner

recommendation

Tax Agent

(Explanation)

Appraiser Signature

Date

Appraisal District

Taxing Unit

CAD PART 2:

TAX YEAR

2017

2016

2015

2014

2013

2012

Value information

IMPRV HS

IMPRV NON-HS

LAND HS

LAND NON-HS

AG MKT

AG USE

MARKET

APPRAISED

HS CAP LOSS

ASSESSED

CAD PART 3:

Agree

Disagree

Director of Operations Signature

Date

Correction

approval

Agree

Disagree

Director of Appraisal Signature

Date

07172013BCADKLM

1

1