*VAST9R113888*

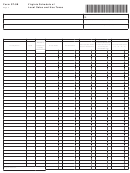

Form ST-9R

Virginia Schedule of Regional

State Sales and Use Tax

• If you are reporting consolidated sales for business locations in more than one locality or you do not have a fixed location for your business, file Form ST-9B with

Form ST-9 to allocate local sales to the appropriate Virginia locality. You must also file Form ST-9R if you are required to File Form ST-9B and you are reporting

sales in the Northern Virginia or Hampton Roads Regions.

• Sourcing rules are summarized in guidelines for the retail sales and use tax changes enacted by the 2013 General Assembly. See Public Document 13-57

available at

Name

Account Number

10-

Address

Filing Period (Enter month or quarter and year)

City, State, ZIP

Due Date (20th of month following end of period)

Northern Virginia Region

A

B

C

D

E

F

Gross Sales &

Exempt State Sales &

Qualifying Food

Regional Taxable Sales

Locality Name

Code

Personal Use

Other Deductions

Sales & Use

(= C - D - E)

Alexandria City

51510

Arlington County

51013

Fairfax City

51600

Fairfax County

51059

Falls Church City

51610

Loudoun County

51107

Manassas City

51683

Manassas Park City

51685

Prince William County

51153

Totals Northern Virginia

Transfer amount above to

Line 10a, Col. A, Form ST-9.

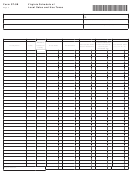

Hampton Roads Region

A

B

C

D

E

F

Gross Sales &

Exempt State Sales &

Qualifying Food

Regional Taxable Sales

Locality Name

Code

Personal Use

Other Deductions

Sales & Use

(= C - D - E)

Chesapeake City

51550

Franklin City

51620

Hampton City

51650

Isle of Wight County

51093

James City County

51095

Newport News City

51700

Norfolk City

51710

Poquoson City

51735

Portsmouth City

51740

Southampton County

51175

Suffolk City

51800

Virginia Beach City

51810

Williamsburg City

51830

York County

51199

Totals Hampton Roads

Transfer amount above to

Line 10b, Col. A, Form ST-9.

Form ST-9R 6201055 Rev. 03/13

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10