Form Cr - Claim Of Right Income Repayments

ADVERTISEMENT

For Tax Year

CLAIM OF RIGHT

CR

INCOME REPAYMENTS

ORS 315.068

You are allowed a credit or a deduction if you repaid money during the year that you reported as taxable income in an

earlier year. You must have deducted the repayment or claimed a credit on your federal return.

Did you claim the repayment as a credit on your federal return? If so, you have two choices:

• You may claim a credit on your Oregon return. No adjustment to your income is necessary.

OR

• You may claim the repayment as a subtraction on your Oregon return. Enter the amount as an “Other subtraction,” and

label the line “COR.”

Did you claim the repayment as a deduction on your federal return? If so, you have two choices:

• You may claim it as a deduction on your Oregon return.

OR

• You may claim it as an Oregon tax credit.

Use this worksheet to determine whether to take a deduction or a credit for Oregon.

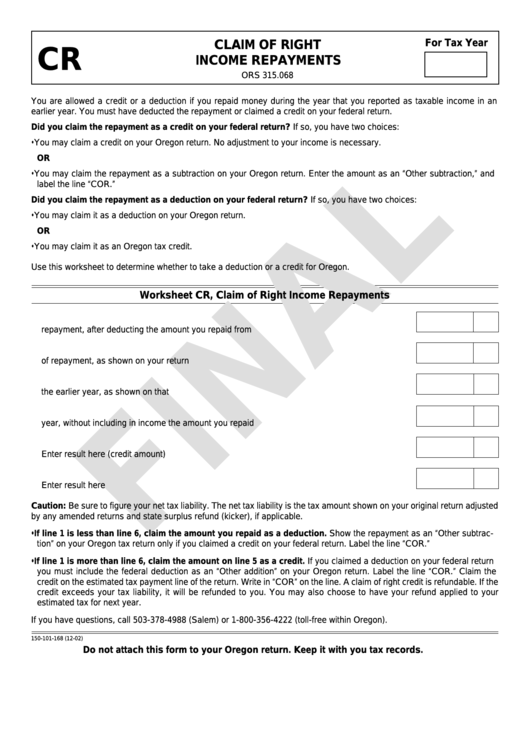

Worksheet CR, Claim of Right Income Repayments

1. Refigure your Oregon tax for the year of

repayment, after deducting the amount you repaid from income ................................................. 1

2. Enter your Oregon tax for the year

of repayment, as shown on your return ........................................................................................ 2

3. Enter your net tax liability from

the earlier year, as shown on that return ..................................................................................... 3

4. Refigure your net tax liability for the earlier

year, without including in income the amount you repaid ............................................................. 4

5. Subtract line 4 from line 3.

Enter result here (credit amount) .................................................................................................. 5

6. Subtract line 5 from line 2.

Enter result here ........................................................................................................................... 6

Caution: Be sure to figure your net tax liability. The net tax liability is the tax amount shown on your original return adjusted

by any amended returns and state surplus refund (kicker), if applicable.

• If line 1 is less than line 6, claim the amount you repaid as a deduction. Show the repayment as an “Other subtrac-

tion” on your Oregon tax return only if you claimed a credit on your federal return. Label the line “COR.”

• If line 1 is more than line 6, claim the amount on line 5 as a credit. If you claimed a deduction on your federal return

you must include the federal deduction as an “Other addition” on your Oregon return. Label the line “COR.” Claim the

credit on the estimated tax payment line of the return. Write in “COR” on the line. A claim of right credit is refundable. If the

credit exceeds your tax liability, it will be refunded to you. You may also choose to have your refund applied to your

estimated tax for next year.

If you have questions, call 503-378-4988 (Salem) or 1-800-356-4222 (toll-free within Oregon).

150-101-168 (12-02)

Do not attach this form to your Oregon return. Keep it with you tax records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1