Instructions For Schedules O And P (Form N-30) - Hawaii Allocation And Apportionment Of Income

ADVERTISEMENT

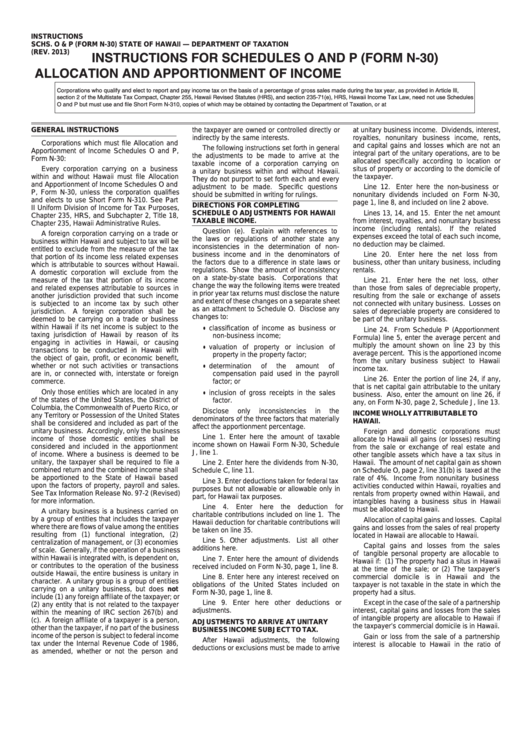

INSTRUCTIONS

SCHS. O & P (FORM N-30)

STATE OF HAWAII — DEPARTMENT OF TAXATION

INSTRUCTIONS FOR SCHEDULES O AND P (FORM N-30)

(REV. 2013)

ALLOCATION AND APPORTIONMENT OF INCOME

Corporations who qualify and elect to report and pay income tax on the basis of a percentage of gross sales made during the tax year, as provided in Article III,

section 2 of the Multistate Tax Compact, Chapter 255, Hawaii Revised Statutes (HRS), and section 235-71(e), HRS, Hawaii Income Tax Law, need not use Schedules

O and P but must use and file Short Form N-310, copies of which may be obtained by contacting the Department of Taxation, or at tax.hawaii.gov.

GENERAL INSTRUCTIONS

the taxpayer are owned or controlled directly or

at unitary business income. Dividends, interest,

indirectly by the same interests.

royalties, nonunitary business income, rents,

Corporations which must file Allocation and

and capital gains and losses which are not an

The following instructions set forth in general

Apportionment of Income Schedules O and P,

integral part of the unitary operations, are to be

the adjustments to be made to arrive at the

Form N-30:

allocated specifically according to location or

taxable income of a corporation carrying on

Every corporation carrying on a business

situs of property or according to the domicile of

a unitary business within and without Hawaii.

within and without Hawaii must file Allocation

the taxpayer.

They do not purport to set forth each and every

and Apportionment of Income Schedules O and

adjustment to be made.

Specific questions

Line 12. Enter here the non-business or

P, Form N-30, unless the corporation qualifies

should be submitted in writing for rulings.

nonunitary dividends included on Form N-30,

and elects to use Short Form N-310. See Part

page 1, line 8, and included on line 2 above.

DIRECTIONS FOR COMPLETING

II Uniform Division of Income for Tax Purposes,

SCHEDULE O ADJUSTMENTS FOR HAWAII

Lines 13, 14, and 15. Enter the net amount

Chapter 235, HRS, and Subchapter 2, Title 18,

TAXABLE INCOME.

from interest, royalties, and nonunitary business

Chapter 235, Hawaii Administrative Rules.

income (including rentals).

If the related

Question (e).

Explain with references to

A foreign corporation carrying on a trade or

expenses exceed the total of each such income,

the laws or regulations of another state any

business within Hawaii and subject to tax will be

no deduction may be claimed.

inconsistencies in the determination of non-

entitled to exclude from the measure of the tax

business income and in the denominators of

Line 20.

Enter here the net loss from

that portion of its income less related expenses

the factors due to a difference in state laws or

business, other than unitary business, including

which is attributable to sources without Hawaii.

regulations. Show the amount of inconsistency

rentals.

A domestic corporation will exclude from the

on a state-by-state basis.

Corporations that

measure of the tax that portion of its income

Line 21.

Enter here the net loss, other

change the way the following items were treated

and related expenses attributable to sources in

than those from sales of depreciable property,

in prior year tax returns must disclose the nature

another jurisdiction provided that such income

resulting from the sale or exchange of assets

and extent of these changes on a separate sheet

is subjected to an income tax by such other

not connected with unitary business. Losses on

as an attachment to Schedule O. Disclose any

jurisdiction.

A foreign corporation shall be

sales of depreciable property are considered to

changes to:

deemed to be carrying on a trade or business

be part of the unitary business.

within Hawaii if its net income is subject to the

•

classification of income as business or

Line 24. From Schedule P (Apportionment

taxing jurisdiction of Hawaii by reason of its

non-business income;

Formula) line 5, enter the average percent and

engaging in activities in Hawaii, or causing

multiply the amount shown on line 23 by this

•

valuation of property or inclusion of

transactions to be conducted in Hawaii with

average percent. This is the apportioned income

property in the property factor;

the object of gain, profit, or economic benefit,

from the unitary business subject to Hawaii

•

whether or not such activities or transactions

determination

of

the

amount

of

income tax.

are in, or connected with, interstate or foreign

compensation paid used in the payroll

Line 26. Enter the portion of line 24, if any,

commerce.

factor; or

that is net capital gain attributable to the unitary

Only those entities which are located in any

•

inclusion of gross receipts in the sales

business. Also, enter the amount on line 26, if

of the states of the United States, the District of

factor.

any, on Form N-30, page 2, Schedule J, line 13.

Columbia, the Commonwealth of Puerto Rico, or

Disclose

only

inconsistencies

in

the

INCOME WHOLLY ATTRIBUTABLE TO

any Territory or Possession of the United States

denominators of the three factors that materially

HAWAII.

shall be considered and included as part of the

affect the apportionment percentage.

unitary business. Accordingly, only the business

Foreign and domestic corporations must

Line 1. Enter here the amount of taxable

income of those domestic entities shall be

allocate to Hawaii all gains (or losses) resulting

income shown on Hawaii Form N-30, Schedule

considered and included in the apportionment

from the sale or exchange of real estate and

J, line 1.

of income. Where a business is deemed to be

other tangible assets which have a tax situs in

unitary, the taxpayer shall be required to file a

Line 2. Enter here the dividends from N-30,

Hawaii. The amount of net capital gain as shown

combined return and the combined income shall

Schedule C, line 11.

on Schedule O, page 2, line 31(b) is taxed at the

be apportioned to the State of Hawaii based

rate of 4%. Income from nonunitary business

Line 3. Enter deductions taken for federal tax

upon the factors of property, payroll and sales.

activities conducted within Hawaii, royalties and

purposes but not allowable or allowable only in

See Tax Information Release No. 97-2 (Revised)

rentals from property owned within Hawaii, and

part, for Hawaii tax purposes.

for more information.

intangibles having a business situs in Hawaii

Line 4. Enter here the deduction for

must be allocated to Hawaii.

A unitary business is a business carried on

charitable contributions included on line 1. The

by a group of entities that includes the taxpayer

Allocation of capital gains and losses. Capital

Hawaii deduction for charitable contributions will

where there are flows of value among the entities

gains and losses from the sales of real property

be taken on line 35.

resulting from (1) functional integration, (2)

located in Hawaii are allocable to Hawaii.

Line 5. Other adjustments.

List all other

centralization of management, or (3) economies

Capital gains and losses from the sales

additions here.

of scale. Generally, if the operation of a business

of tangible personal property are allocable to

within Hawaii is integrated with, is dependent on,

Line 7. Enter here the amount of dividends

Hawaii if: (1) The property had a situs in Hawaii

or contributes to the operation of the business

received included on Form N-30, page 1, line 8.

at the time of the sale; or (2) The taxpayer’s

outside Hawaii, the entire business is unitary in

Line 8. Enter here any interest received on

commercial domicile is in Hawaii and the

character. A unitary group is a group of entities

obligations of the United States included on

taxpayer is not taxable in the state in which the

carrying on a unitary business, but does not

Form N-30, page 1, line 8.

property had a situs.

include (1) any foreign affiliate of the taxpayer; or

Line 9. Enter here other deductions or

Except in the case of the sale of a partnership

(2) any entity that is not related to the taxpayer

adjustments.

interest, capital gains and losses from the sales

within the meaning of IRC section 267(b) and

of intangible property are allocable to Hawaii if

(c). A foreign affiliate of a taxpayer is a person,

ADJUSTMENTS TO ARRIVE AT UNITARY

the taxpayer’s commercial domicile is in Hawaii.

other than the taxpayer, if no part of the business

BUSINESS INCOME SUBJECT TO TAX.

income of the person is subject to federal income

Gain or loss from the sale of a partnership

After Hawaii adjustments, the following

tax under the Internal Revenue Code of 1986,

interest is allocable to Hawaii in the ratio of

deductions or exclusions must be made to arrive

as amended, whether or not the person and

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2