Form Wh-405 - Batch Filing Program For Withholding Quarterly Tax Returns - South Carolina Department Of Revenue Page 23

ADVERTISEMENT

SECTION: 02 - FILE PROCESSING CRITERIA: (CONTINUED)

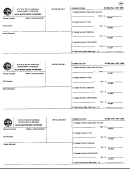

02.03 - EXPLANATION of the EMPLOYER TAX RETURN "SE" RECORD

The Employer Tax Return "SE" Record contains the quarterly tax information for each Employer reported by the

Reporting Agent. The number of Tax Return Data "SE" Records appearing on the file depends on the number of

taxpayers represented - one Tax Return for each SC Withholding File # for each Quarter reported.

(See Section 03.02 for complete field descriptions and character positions).

(1)

Only Forms WH-1605 and WH-1606 may be present.

(2)

Multiple Employer Tax Return "SE" data records may be present on the file. (only one "SE"

Record for each SC Withholding File # for each Quarter reported).

(3)

The first "SE" Record must follow the Agent "SA" Record on the file.

(4)

The last "SE" Record must be followed by the End-of-File Total "ST" Record.

(5)

No special characters may be used in any field in this record.

(6)

All fields in the record are required.

(7)

Fields designated as "Alpha or A/N" must be left-justified and space-filled-to-right. All unused alpha and

alphanumeric fields must be space-filled.

(8)

All money fields (designated as "Num$"), must contain dollars and cents with an implied decimal. They

must be unpacked, unsigned, right-justified and zero-filled-to-left. The only valid values are 0-9. (No

special characters allowed). All unused money fields must be zero-filled.

(9)

Numeric fields containing no dollar amounts (designated as "Num"), must be unpacked, unsigned,

right-justified and zero-filled-to-left. The only valid values are 0-9. (No special characters allowed). All

unused numeric fields must be zero-filled.

(10)

The record length must be 300 bytes/characters.

(11)

Errors in the data or structure of this "SE" Record could prevent processing of the file.

02.04 - EXPLANATION of the END-of-FILE TOTAL "ST" RECORD

The End-of-File Total "ST" Record contains a count of all Tax Return Data "SE" Records appearing on the file,

and aggregate totals for each money field required to be reported on the "SE" Records. (See Section 03.03 for

complete field descriptions and character positions).

(1)

The End-of-File Total "ST" Record must be the last data record on the file. (only one "ST" Record

per file.)

(2)

The "ST" Record must follow the last "SE" Employer Tax Return Record on the file.

(3)

No special characters may be used in any field in this record.

(4)

All fields in the record are required.

(5)

Fields designated as "Alpha or A/N" must be left-justified and space-filled-to-right. All unused alpha and

alphanumeric fields must be space-filled.

20

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29