Form 4585 - Michigan Business Tax Investment Tax Credit Recapture From Sale Of Assets Acquired Under Single Business Tax - 2012 Page 6

ADVERTISEMENT

group for each year that pertains to the specific member

Dates should match those listed on lines 1, 2, and 3,

that is disposing of SBT ITC asset in the current tax year.

columns A. List each date only once.

For example: in 2008, group ABC files MBT return

•

Line 7, column C: For each taxable year on

claiming $1,000,000 in SBT ITC credit carryforward. The

line 6, column A, find the corresponding SBT ITC

group consisted of Company 1, Company 2, and Company

amount reported on line 4, column C, and Net Capital

3. The total $1,000,000 in SBT ITC credit carryforward

Investment amount reported on line 4, column B.

resulted from the sum of $200,000 in SBT ITC credit

Divide amounts from line 4, column C by amounts

carryforward from Company 1, $300,000 from Company

from line 4, column B for each taxable year and enter

2, and $500,000 from Company 3. In the current year,

results here.

If the quotient of that division for a

company 2 and company 3 dispose of capital investment

particular tax year listed equals zero, and the amount

that triggers SBT ITC credit recapture.

Therefore,

on line 7, column B is positive, instead of zero, enter

group ABC files a Form 4902 to report the sum of SBT

the following on line 7, column C as appropriate:

ITC credit recapture from Company 2 and company 3.

When filling the line 5, column B for Company 2, report

1)

Taxpayer used the straight method to

$200,000 – which represents the portion of the total SBT

calculate the SBT liability for that taxable years:

ITC credit carryforward claimed by the group in 2008

calculated the credit rate on C-8000ITC, line 26 for

that corresponds only to Company 2’s SBT ITC credit

that taxable year, and enter the result here;

carryforward in 2008. When filling line 5, column B for

2)

Taxpayer used the excess compensation

Company 3, report $500,000 – which represents Company

reduction method to calculate the SBT liability for that

3’s portion of the total SBT ITC credit carryforward

taxable year: calculate the credit rate on C 8000ITC,

claimed by the group in 2008.

line 26 for that taxable year, and multiply that rate by

○ Line 4, column E: For each taxable year, enter the

the percentage on C-8000S, line 6. Enter the result

rates calculated on Table I, line 9, column M.

here.

○ Filling table I at the end of these Instructions (lines

•

Line 9, column J: Enter amount of ITC credit

and columns not listed are explained on the table):

used provided by the webtool that corresponds to each

•

Line 7, column A: Enter only taxable years

taxable year displayed on line 9, column I. Access the

in which SBT ITC disposed assets were acquired.

Michigan Department of Treasury (Treasury) Web tool

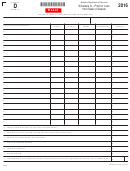

Table I: Determining Credit Amount that Offsets Credit Recapture

7.

A

B

C

D

Taxable Year

(End Date)

In Which MBT ITC

SBT ITC Credit Rate

SBT Capital

Divide line 4, column C,

Gross SBT ITC Credit Amount

Disposed Asset Was

Acquired

Investment Amount

by line 4, column B

Multiply column B

(C-8000ITC, line 10)

by column C

(MM-DD-YYY)

(See Instructions if zero)

8.

E

F

G

H

SBT Recapture Capital

Taxable Year

SBT Recapture Amount Offset

Gross SBT ITC Credit Recapture

by Credit

(repeat from

Investment Amount

(C-8000ITC, line 23)

Multiply column F by column C

Lesser of columns D and G

column A)

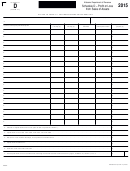

9.

I

J

K

L

M

SBT ITC Recapture Rate

Extent Credit Used Rate

Multiply columns C

SBT ITC Credit Amount

and L. Carry amount to

Taxable Year

Divide column K

Total SBT ITC Credit Amount Used

(repeat from

That offsets SBT liability

by column D

Worksheet 4a, line 4,

Add columns J and H

column A)

(from webtool)

(cannot be more than 1)

column E

146

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7