Instructions For Schedule U-Drd - Member'S Dividends Received Deduction - 2012 Page 2

ADVERTISEMENT

than such business (i.e., the dividends are considered separate income of the member), enter “0”

to designate that the deduction will be claimed on Schedule U-MTI.

If the combined group is not subject to an affiliated group election and the group has more than

one unitary business, enter the unitary business identifier that corresponds to the Schedule U-E

on which the dividends are to be reported (note that the identifier in such cases must be greater

than zero).

Also enter the name of the principal reporting corporation, the Federal Identification number of

the principal reporting corporation and the ending date of the combined group’s taxable year.

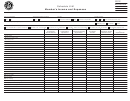

Line Instructions for Schedule U-DRD

Line 1. Enter the total dividends received by the member. If an affiliated group election has not

been made and the member has income from one or more sources other than the combined

group’s unitary business or the combined group has more than one unitary business, enter the

total of the dividends received by the member for which a dividends received deduction is being

claimed as reported on the member’s Schedule U-E or U-MTI.

Line 2. A dividend paid by one combined group member to another combined group member is

eliminated if paid out of the earnings and profits of the unitary business included in a combined

report, as filed for either the current tax year or an earlier tax year. See 830 CMR 63.32B.2 (6)

(c) 4. If any of the dividends included in line 1 were eliminated from group income under this

rule, enter the total amount of such dividends eliminated on this line.

Line 4. If the member that files Schedule U-DRD is a utility corporation, repeat the amount

stated on line 3 on this line and skip to line 13.

Lines 5 through 9. Enter the total, by line, of the dividends included in line 3 that were received

by a financial institution or business corporation in the instance where such dividends as paid to

such recipient do not qualify for the dividends received deduction.

Line 12. Multiply the amount on line 11 by 95%, round to the nearest whole dollar.

Line 13. Enter the total amount of dividends that qualify for the deduction. This may not be

more than the amount on line 4. A financial institution or business corporation that completes

this Schedule U-DRD must enter "0".

Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2