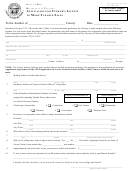

APPLICATION CHECKLIST

Part of State Form 45899 (R5 / 12-09)

This Application for Certification of Exemption represents a statement by you that you are an independent contractor or otherwise not required to carry worker’s

compensation insurance on yourself under the Worker’s Compensation Act of Indiana. The Indiana Department of Revenue may share this information

with the Internal Revenue Service (IRS) and /or other states.

The statutes establishing this registration process state that an independent contractor in the construction trades is defined similarly to the IRS tax guidelines

for determining independent contractor status. The IRS uses several factors to determine whether an individual is an independent contractor or an employee.

Listed below are some of the characteristics of each. If you fail to meet these qualifications, you will not receive certification.

An independent contractor generally:

• directs his own work and performs the work in the manner he chooses, without direction from a boss or general contractor;

• sets his own hours;

• may hire assistants;

• provides his own tools and materials;

• is paid by the job rather than by the hour;

• may make a profit or suffer a loss on a job; and

• is free to work for more than one person or firm and to offer his services to the general public.

An employee generally:

• is under the control of his employer;

• has income taxes withheld from his pay;

• must work the hours specified by the employer;

• receives pay on an hourly basis;

• must perform the work in the manner indicated by the employer;

• receives training, tools and equipment provided by the employer;

• is not free to offer his services to any persons or firms or to the general public; and

• can be fired at any time.

Are you new to the state of Indiana or the United States? If so, you will be required to submit verification of your residency.

Some examples include:

• valid Indiana Driver’s Licence;

• Permanent Resident Card (green card);

• copy of income tax return from another state;

• copy of federal income tax return;

• voter’s registration card;

• Individual Tax Identification Number (ITIN) (resident aliens)

This application for a Certification of Exemption from worker’s compensation in Indiana will be processed by verifying your status as an Independent Contractor.

The Indiana Department of Revenue will examine your past tax records to determine if you have identified yourself as an independent contractor in past years

and are current on your individual tax filings. Failure to comply will result in denial of certification.

I.C.22-3-2-14.5 requires that you be certified by the Department of Revenue. The Certification is filed for you with the Indiana Worker’s Compensation Board to

obtain your Independent Contractor status. You are required to pay a $20 fee, $5 (non-refundable) to the Indiana Department of Revenue and $15 to the Indiana

Worker’s Compensation Board, for making the application. Please allow up to seven business days for the Department of Revenue and an additional seven days

for the Workers Compensation Board to process this request. If you do not meet the criteria for establishing your status as an independent contractor, you will

be contacted with instructions on providing additional information, or notification of denial.

Your certification is not valid until the Worker’s Compensation Board has stamped it. Mail your application to the Indiana Department of Revenue for processing.

Upon approval of both the Department of Revenue and the Worker’s Compensation Board, you will receive your validated Certificate of Exemption and a copy

of Income Tax Information Bulletin #86 in the mail.

Note: Until / unless you receive a Certificate of Exemption from the Indiana Worker’s Compensation Board, you are required to be covered by a worker’s

compensation policy under Indiana law. Even if you are exempt, you must cover any employees of your business.

1

1 2

2