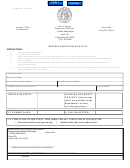

PRINT

CLEAR

FORM Rev. (04.14.16)

State of Georgia

Lynnette T. Riley

Staci Guest

Department of Revenue

Commissioner

Chief Tax Officer

314 East Main Street

Suite 150

Cartersville, GA 30120

(770) 387-4060

MISCELLANEOUS SALES EVENT

INSTRUCTIONS:

1)

Complete seller’s information.

2)

Complete event information.

3)

Report the amount of taxable sales. If no taxable sales are made, a zero should be entered on this line.

4)

Collect Georgia sales tax at the rate of the county in which the event is held. Report the amount of taxable sales made and

sales tax collected.

5)

Pay to the GEORGIA DEPARTMENT OF REVENUE, by check or money order, the amount of sales tax collected.

DO NOT SEND CASH.

6)

If you are registered with the STATE OF GEORGIA for SALES AND USE TAX and will include these sales on your regular return,

please provide your sales tax number: __ __ __ -- __ __ __ __ __ __ .

1. SELLER’S NAME

SELLER’S ADDRESS

SELLER’S TELEPHONE NUMBER

SELLER’S E-MAIL ADDRESS

2. NAME OF EVENT (IF APPLICABLE)

DATE OF EVENT

COUNTY OF EVENT

TAX RATE OF COUNTY

OF EVENT. Sales tax rate

charts are available on the

Department’s website,

3. TAXABLE SALES

4. TAX COLLECTED

5. AT THE CLOSE OF THE EVENT, THIS FORM AND ALL TAXES COLLECTED MUST BE:

[

] Returned to the Revenue Agent on duty.

[

] Mailed within 3 days to the address below.

Should you have any questions, please contact:

Georgia Department of Revenue

Cartersville

314 East Main Street

Suite 150

Cartersville, GA 30120

___________________________

Authorized Agent

for State Revenue Commissioner

TELEPHONE NUMBER:

(770) 387-4060

DATE:

1

1