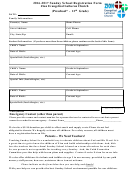

Self-Employment (Short) Form - Hm Revenue & Customs - April 2016-2017

ADVERTISEMENT

Tax Rebate Specialists -

Self-employment

Tax year 6 April 2016 to 5 April 2017 (2016–17)

(short)

Please read the

‘Self-employment (short)

notes’ to check if you should use this page or the ‘Self-employment (full)’ page.

To get notes and helpsheets that will help you fill in this form, go to

Your name

Your Unique Taxpayer Reference (UTR)

Business details

Description of business

If your business started after 5 April 2016, enter the

5

1

start date DD MM YYYY

If your business ceased before 6 April 2017, enter the

6

Postcode of your business address

2

final date of trading DD MM YYYY

If your business name, description, address or postcode

3

Date your books or accounts are made up to

7

have changed in the last 12 months, put ‘X’ in the box

– read the notes

and give details in the ‘Any other information’ box of

your tax return

If you used the cash basis

,

money actually received

8

and paid out, to calculate your income and expenses

If you are a foster carer or shared lives carer, put ‘X’

4

put ‘X’ in the box – read the notes

in the box – read the notes

Business income – if your annual business turnover was below £83,000

Your turnover – the takings, fees, sales or money earned

Any other business income not included in box 9

10

9

by your business

£

0 0

•

£

0 0

•

Allowable business expenses

If your annual turnover was below £83,000 you may just put your total expenses in box 20, rather than filling in the whole section.

Costs of goods bought for resale or goods used

Accountancy, legal and other professional fees

11

16

£

0 0

£

0 0

•

•

Car, van and travel expenses

Interest and bank and credit card etc financial charges

12

17

– after private use proportion

£

0 0

•

£

0 0

•

Phone, fax, stationery and other office costs

18

Wages, salaries and other staff costs

13

£

0 0

•

£

0 0

•

Other allowable business expenses – client entertaining

19

Rent, rates, power and insurance costs

costs are not an allowable expense

14

£

0 0

£

0 0

•

•

Repairs and maintenance of property and equipment

Total allowable expenses – total of boxes 11 to 19

15

20

£

0 0

£

0 0

•

•

SA103S 2017

HMRC 12/16

Page SES 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2