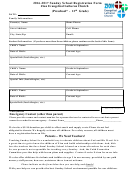

Self-Employment (Short) Form - Hm Revenue & Customs - April 2016-2017 Page 2

ADVERTISEMENT

Net profit or loss

Net profit – if your business income is more than your

Or, net loss – if your expenses exceed your business

21

22

expenses (if box 9 + box 10 minus box 20 is positive)

income (if box 20 minus (box 9 + box 10) is positive)

£

0 0

£

0 0

•

•

Tax allowances for vehicles and equipment (capital allowances)

There are ‘capital’ tax allowances available for vehicles and equipment used in your business. (Please don’t include the cost

of these in your business expenses.)

Annual Investment Allowance

Other capital allowances

23

25

£

0 0

£

0 0

•

•

Allowance for small balance of unrelieved expenditure

Total balancing charges – where you have disposed

24

26

of items for more than their tax value

£

0 0

•

£

0 0

•

Calculating your taxable profits

Your taxable profit may not be the same as your net profit. Please read the ‘Self-employment (short) notes’ to see if you need

to make any adjustments and fill in the boxes which apply to arrive at your taxable profit for the year.

Goods and/or services for your own use

Loss brought forward from earlier years set off against

27

29

– read the notes

this year’s profits – up to the amount in box 28

£

0 0

£

0 0

•

•

Net business profit for tax purposes (if box 21 + box 26

Any other business income not included in box 9 or box 10

28

30

+ box 27 minus (boxes 22 to 25) is positive)

– for example, non arm’s length reverse premiums

£

0 0

£

0 0

•

•

Total taxable profits or net business loss

If your total profits from all Self-employments and Partnerships for 2016–17 are less than £5,965, you do not have to pay

Class 2 National Insurance contributions, but you may want to pay voluntarily (box 36) to protect your rights to certain benefits.

Read the notes.

Total taxable profits from this business (if box 28

Net business loss for tax purposes (if boxes 22 to 25

31

32

+ box 30 minus box 29 is positive)

minus (box 21 + box 26 + box 27) is positive)

£

0 0

£

0 0

•

•

Losses, Class 2 and Class 4 National Insurance contributions (NICs) and CIS deductions

If you have made a loss for tax purposes (box 32), read the ‘Self-employment (short) notes’ and fill in boxes 33 to 35 as appropriate.

Loss from this tax year set off against other income

If your total profits for 2016–17 are less than £5,965

33

36

for 2016–17

and you choose to pay Class 2 NICs voluntarily,

put ‘X’ in the box – read the notes

£

0 0

•

Loss to be carried back to previous year(s) and set off

34

against income (or capital gains)

If you are exempt from paying Class 4 NICs, put ‘X’ in

37

the box – read the notes

£

0 0

•

Total loss to carry forward after all other set-offs

35

– including unused losses brought forward

Total Construction Industry Scheme (CIS) deductions

38

taken from your payments by contractors

£

0 0

•

– CIS subcontractors only

£

0 0

•

SA103S 2017

Page SES 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2