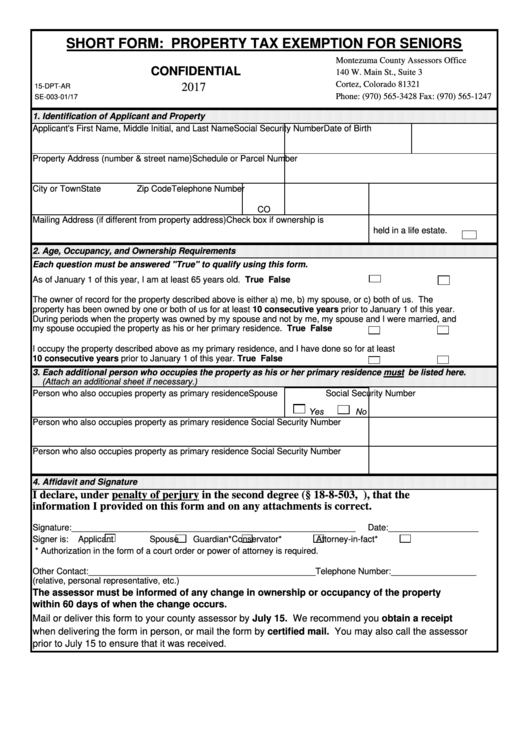

SHORT FORM: PROPERTY TAX EXEMPTION FOR SENIORS

Montezuma County Assessors Office

CONFIDENTIAL

140 W. Main St., Suite 3

Cortez, Colorado 81321

2017

15-DPT-AR

Phone: (970) 565-3428 Fax: (970) 565-1247

SE-003-01/17

1. Identification of Applicant and Property

Applicant's First Name, Middle Initial, and Last Name

Social Security Number

Date of Birth

Property Address (number & street name)

Schedule or Parcel Number

City or Town

State

Zip Code

Telephone Number

CO

Mailing Address (if different from property address)

Check box if ownership is

held in a life estate.

2. Age, Occupancy, and Ownership Requirements

Each question must be answered "True" to qualify using this form.

As of January 1 of this year, I am at least 65 years old.

True

False

The owner of record for the property described above is either a) me, b) my spouse, or c) both of us. The

property has been owned by one or both of us for at least 10 consecutive years prior to January 1 of this year.

During periods when the property was owned by my spouse and not by me, my spouse and I were married, and

my spouse occupied the property as his or her primary residence.

True

False

I occupy the property described above as my primary residence, and I have done so for at least

10 consecutive years prior to January 1 of this year.

True

False

3. Each additional person who occupies the property as his or her primary residence must be listed here.

(Attach an additional sheet if necessary.)

Person who also occupies property as primary residence

Spouse

Social Security Number

Yes

No

Person who also occupies property as primary residence

Social Security Number

Person who also occupies property as primary residence

Social Security Number

4. Affidavit and Signature

I declare, under penalty of perjury in the second degree (§ 18-8-503, C.R.S.), that the

information I provided on this form and on any attachments is correct.

Signature:____________________________________________________________

Date:___________________

Signer is:

Applicant

Spouse

Guardian*

Conservator*

Attorney-in-fact*

* Authorization in the form of a court order or power of attorney is required.

Other Contact:________________________________________________Telephone Number:__________________

(relative, personal representative, etc.)

The assessor must be informed of any change in ownership or occupancy of the property

within 60 days of when the change occurs.

Mail or deliver this form to your county assessor by July 15. We recommend you obtain a receipt

when delivering the form in person, or mail the form by certified mail. You may also call the assessor

prior to July 15 to ensure that it was received.

1

1 2

2 3

3