Form 8862 - Information To Claim Earned Income Credit After Disallowance With Instructions - 2005

ADVERTISEMENT

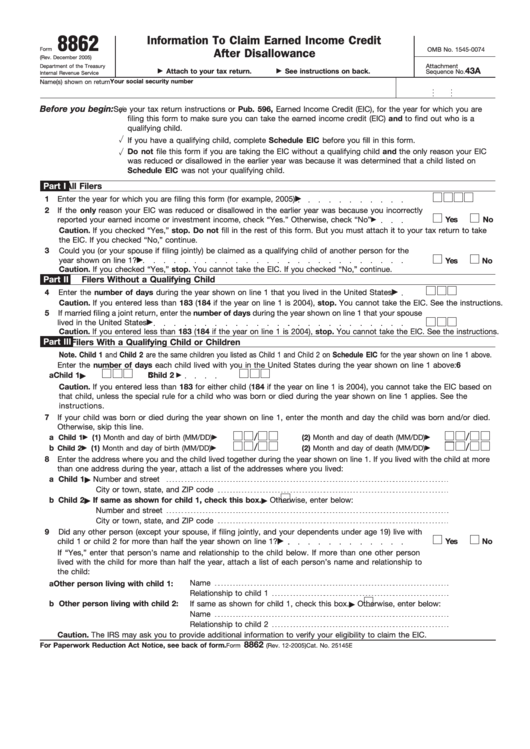

8862

Information To Claim Earned Income Credit

Form

OMB No. 1545-0074

After Disallowance

(Rev. December 2005)

Attachment

Department of the Treasury

43A

Attach to your tax return.

See instructions on back.

Sequence No.

Internal Revenue Service

Your social security number

Name(s) shown on return

Before you begin:

See your tax return instructions or Pub. 596, Earned Income Credit (EIC), for the year for which you are

filing this form to make sure you can take the earned income credit (EIC) and to find out who is a

qualifying child.

If you have a qualifying child, complete Schedule EIC before you fill in this form.

Do not file this form if you are taking the EIC without a qualifying child and the only reason your EIC

was reduced or disallowed in the earlier year was because it was determined that a child listed on

Schedule EIC was not your qualifying child.

Part I

All Filers

1

Enter the year for which you are filing this form (for example, 2005)

2

If the only reason your EIC was reduced or disallowed in the earlier year was because you incorrectly

reported your earned income or investment income, check “Yes.” Otherwise, check “No”

Yes

No

Caution. If you checked “Yes,” stop. Do not fill in the rest of this form. But you must attach it to your tax return to take

the EIC. If you checked “No,” continue.

3

Could you (or your spouse if filing jointly) be claimed as a qualifying child of another person for the

year shown on line 1?

Yes

No

Caution. If you checked “Yes,” stop. You cannot take the EIC. If you checked “No,” continue.

Part II

Filers Without a Qualifying Child

4

Enter the number of days during the year shown on line 1 that you lived in the United States

Caution. If you entered less than 183 (184 if the year on line 1 is 2004), stop. You cannot take the EIC. See the instructions.

5

If married filing a joint return, enter the number of days during the year shown on line 1 that your spouse

lived in the United States

Caution. If you entered less than 183 (184 if the year on line 1 is 2004), stop. You cannot take the EIC. See the instructions.

Part III

Filers With a Qualifying Child or Children

Note. Child 1 and Child 2 are the same children you listed as Child 1 and Child 2 on Schedule EIC for the year shown on line 1 above.

6

Enter the number of days each child lived with you in the United States during the year shown on line 1 above:

a Child 1

b

Child 2

Caution. If you entered less than 183 for either child (184 if the year on line 1 is 2004), you cannot take the EIC based on

that child, unless the special rule for a child who was born or died during the year shown on line 1 applies. See the

instructions.

7

If your child was born or died during the year shown on line 1, enter the month and day the child was born and/or died.

Otherwise, skip this line.

/

/

a

Child 1

(1) Month and day of birth (MM/DD)

(2) Month and day of death (MM/DD)

/

/

b

Child 2

(1) Month and day of birth (MM/DD)

(2) Month and day of death (MM/DD)

8

Enter the address where you and the child lived together during the year shown on line 1. If you lived with the child at more

than one address during the year, attach a list of the addresses where you lived:

a Child 1

Number and street

City or town, state, and ZIP code

b Child 2

If same as shown for child 1, check this box.

Otherwise, enter below:

Number and street

City or town, state, and ZIP code

9

Did any other person (except your spouse, if filing jointly, and your dependents under age 19) live with

child 1 or child 2 for more than half the year shown on line 1?

Yes

No

If “Yes,” enter that person’s name and relationship to the child below. If more than one other person

lived with the child for more than half the year, attach a list of each person’s name and relationship to

the child:

Name

a Other person living with child 1:

Relationship to child 1

b

Other person living with child 2:

If same as shown for child 1, check this box.

Otherwise, enter below:

Name

Relationship to child 2

Caution. The IRS may ask you to provide additional information to verify your eligibility to claim the EIC.

8862

For Paperwork Reduction Act Notice, see back of form.

Cat. No. 25145E

Form

(Rev. 12-2005)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2