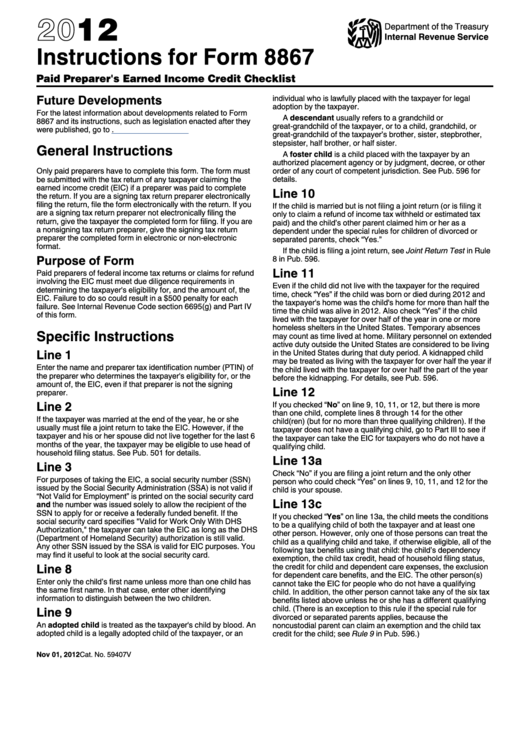

Instructions For Form 8867 - Paid Preparer'S Earned Income Credit Checklist - 2012

ADVERTISEMENT

2012

Department of the Treasury

Internal Revenue Service

Instructions for Form 8867

Paid Preparer's Earned Income Credit Checklist

Future Developments

individual who is lawfully placed with the taxpayer for legal

adoption by the taxpayer.

For the latest information about developments related to Form

A descendant usually refers to a grandchild or

8867 and its instructions, such as legislation enacted after they

great-grandchild of the taxpayer, or to a child, grandchild, or

were published, go to

great-grandchild of the taxpayer’s brother, sister, stepbrother,

stepsister, half brother, or half sister.

General Instructions

A foster child is a child placed with the taxpayer by an

authorized placement agency or by judgment, decree, or other

Only paid preparers have to complete this form. The form must

order of any court of competent jurisdiction. See Pub. 596 for

be submitted with the tax return of any taxpayer claiming the

details.

earned income credit (EIC) if a preparer was paid to complete

Line 10

the return. If you are a signing tax return preparer electronically

filing the return, file the form electronically with the return. If you

If the child is married but is not filing a joint return (or is filing it

are a signing tax return preparer not electronically filing the

only to claim a refund of income tax withheld or estimated tax

return, give the taxpayer the completed form for filing. If you are

paid) and the child’s other parent claimed him or her as a

a nonsigning tax return preparer, give the signing tax return

dependent under the special rules for children of divorced or

preparer the completed form in electronic or non-electronic

separated parents, check “Yes.”

format.

If the child is filing a joint return, see Joint Return Test in Rule

Purpose of Form

8 in Pub. 596.

Line 11

Paid preparers of federal income tax returns or claims for refund

involving the EIC must meet due diligence requirements in

Even if the child did not live with the taxpayer for the required

determining the taxpayer's eligibility for, and the amount of, the

time, check “Yes” if the child was born or died during 2012 and

EIC. Failure to do so could result in a $500 penalty for each

the taxpayer's home was the child's home for more than half the

failure. See Internal Revenue Code section 6695(g) and Part IV

time the child was alive in 2012. Also check “Yes” if the child

of this form.

lived with the taxpayer for over half of the year in one or more

homeless shelters in the United States. Temporary absences

Specific Instructions

may count as time lived at home. Military personnel on extended

active duty outside the United States are considered to be living

Line 1

in the United States during that duty period. A kidnapped child

may be treated as living with the taxpayer for over half the year if

Enter the name and preparer tax identification number (PTIN) of

the child lived with the taxpayer for over half the part of the year

the preparer who determines the taxpayer's eligibility for, or the

before the kidnapping. For details, see Pub. 596.

amount of, the EIC, even if that preparer is not the signing

Line 12

preparer.

Line 2

If you checked “No” on line 9, 10, 11, or 12, but there is more

than one child, complete lines 8 through 14 for the other

If the taxpayer was married at the end of the year, he or she

child(ren) (but for no more than three qualifying children). If the

usually must file a joint return to take the EIC. However, if the

taxpayer does not have a qualifying child, go to Part III to see if

taxpayer and his or her spouse did not live together for the last 6

the taxpayer can take the EIC for taxpayers who do not have a

months of the year, the taxpayer may be eligible to use head of

qualifying child.

household filing status. See Pub. 501 for details.

Line 13a

Line 3

Check “No” if you are filing a joint return and the only other

For purposes of taking the EIC, a social security number (SSN)

person who could check “Yes” on lines 9, 10, 11, and 12 for the

issued by the Social Security Administration (SSA) is not valid if

child is your spouse.

“Not Valid for Employment” is printed on the social security card

Line 13c

and the number was issued solely to allow the recipient of the

SSN to apply for or receive a federally funded benefit. If the

If you checked “Yes” on line 13a, the child meets the conditions

social security card specifies "Valid for Work Only With DHS

to be a qualifying child of both the taxpayer and at least one

Authorization," the taxpayer can take the EIC as long as the DHS

other person. However, only one of those persons can treat the

(Department of Homeland Security) authorization is still valid.

child as a qualifying child and take, if otherwise eligible, all of the

Any other SSN issued by the SSA is valid for EIC purposes. You

following tax benefits using that child: the child’s dependency

may find it useful to look at the social security card.

exemption, the child tax credit, head of household filing status,

Line 8

the credit for child and dependent care expenses, the exclusion

for dependent care benefits, and the EIC. The other person(s)

Enter only the child’s first name unless more than one child has

cannot take the EIC for people who do not have a qualifying

the same first name. In that case, enter other identifying

child. In addition, the other person cannot take any of the six tax

information to distinguish between the two children.

benefits listed above unless he or she has a different qualifying

Line 9

child. (There is an exception to this rule if the special rule for

divorced or separated parents applies, because the

An adopted child is treated as the taxpayer's child by blood. An

noncustodial parent can claim an exemption and the child tax

adopted child is a legally adopted child of the taxpayer, or an

credit for the child; see Rule 9 in Pub. 596.)

Nov 01, 2012

Cat. No. 59407V

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2