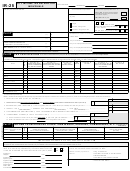

Form Ir-25 - City Income Tax Return For Individuals - City Of Columbus Income Tax Division - 2010 Page 2

ADVERTISEMENT

Name(s) as shown on Page 1

Social Security Number

Stop:

If your only source of income is from wages, do not complete the remainder of this page. Return to Page 1. Copies of your Federal

Schedules C, E and F may be attached to your city return in lieu of completing the schedules below.

SCHEDULE C

Part D

- INCOME FROM SELF-EMPLOYMENT

Profit or Loss from Business (Sole Proprietorship)

If you conducted business in more than one city, you must allocate income on Schedule Y.

Business Name:

Business Address:

Nature of Business:

Employer ID Number, if any:

Has City income tax been withheld from and remitted for all taxable employees

Date Business Started:

during the period covered by this return?

Date City Business Began:

YES

NO

If not, explain on an attached statement.

Accounting Method:

Cash

Accrual

Other

Section 1

INCOME

1. Total Receipts Less Allowances, Rebates and Returns.....................................................................................................

1

2. Less (A) Cost of Goods Sold

or (B) Cost of Operations

, whichever is applicable...................................................

2

Enter Amount of Labor Costs included on Line 2 here

(attach 1099’s if issued)

3. Gross Profit, Subtract Line 2 from Line 1...........................................................................................................................

3

4. Dividends $_______________ + Interest $_______________ + Royalties $_______________ = ....................................

4

5. Rents Received (if connected with trade or business).......................................................................................................

5

6. Other Business Income (attach schedule).......................................................................................................................

6

7. Gross Income. Add Lines 3 through 6..............................................................................................................................

7

EXPENSES

Section 2

8. Advertising & Promotion.....................

8

14. Repairs........................................................

14

9. Bad Debts...........................................

9

15. Salaries & Wages........................................

15

10. Car & Truck Expenses........................

10

16. Compensation of Officers............................

16

11. Depreciation, Amortization, Depletion.

11

17. Commissions (attach 1099’s if issued)........

17

12. Interest on Business Indebtedness.....

12

18. Taxes & Licenses........................................

18

13. Rents (Paid to:

)....

13

19. Other: Attach Schedule if over $5,000.....

19

20. Total Expenses. Add Lines 8 through 19 ..........................................................................................................................

20

21. Net Profit (or Loss) from Business or Profession. Subtract Line 20 from Line 7.................................................................

21

Part E

RENTAL AND PARTNERSHIP INCOME

Section 1

INCOME OR LOSS FROM RENTAL REAL ESTATE

- If income in more than one city, you must use Schedule Y.

Part 1

Property A

Property B

Property C

Property D

1. Address of Property

1

(include No., Street, City

and State................................

2. Rents Received .....................

2

3. Depreciation...........................

3

4. Repairs ..................................

4

5. Other Exp. (attach Sched.).....

5

6. Net Income (Loss)..................

6

7. Local Tax paid........................

7

8. Local jurisdiction paid ............

8

PARTNERSHIP/OTHER INCOME

Section 2

(all taxpayers) - Attach copies of all K-1’s.

Federal Identification #

Income Taxable to

Your Share of City

Your Share of City

Partnership/Source

(if applicable)

What City?

Taxable Income

Taxes Paid

1.

2.

3.

4.

5.

6.

The loss from an unincorporated business activity reported on this page may not be used to offset W-2 wages reported on Page 1. However, the loss from an unincorporated business

RESET FORM

PRINT

activity may be used to offset a gain from another unincorporated business activity if: 1) both unincorporated activities were conducted in the same city; or 2) both unincorporated

activities are taxed by your city of residence. NOTE: Remember to file your Declaration of Estimated Taxes (Form IR-21) for the current year. Phone (614) 645-7370.

Rev. 8/31/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4