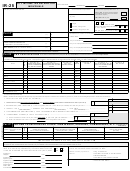

Form Ir-25 - City Income Tax Return For Individuals - City Of Columbus Income Tax Division - 2010 Page 3

ADVERTISEMENT

Name(s) as shown on Page 1

Social Security Number

Schedule Y

BUSINESS ALLOCATION FORMULA

1.

Average original cost of all real and tangible personal property owned or used by the taxpayer in the business or

1

profession wherever situated except leased or rented real property.................................................................................

2

2.

Annual rental on rented and leased real property used by the taxpayer wherever situated multiplied by 8.......................

3

3.

Combine Lines 1 and 2..................................................................................................................................................................

4.

All wages, salaries and other compensation paid to employees wherever their services are performed except compensation

4

§

exempt from municipal taxation under O.R.C.

718.011................................................................................................................

............................................

5

5.

All gross receipts from sales made or services performed wherever made or performed

Column E

Column A

Column B

Column C

Column D

City

Code

Allocated Net Profits

Property

Wages

Gross Receipts

Average %

a

$

$

$

Columbus

01

%

$

b

%

%

%

a

$

$

$

09

Groveport

%

$

b

%

%

%

a

$

$

$

10

Obetz

%

$

b

%

%

%

a

$

$

$

11

Canal Winchester

%

$

b

%

%

%

$

a

$

$

13

Marble Cliff

%

$

b

%

%

%

a

$

$

$

14

Brice

%

$

b

%

%

%

a

$

$

$

16

Harrisburg

%

$

b

%

%

%

a

$

$

$

Everywhere Else

%

$

b

%

%

%

PRINT

RESET FORM

(Rev. 8/31/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4