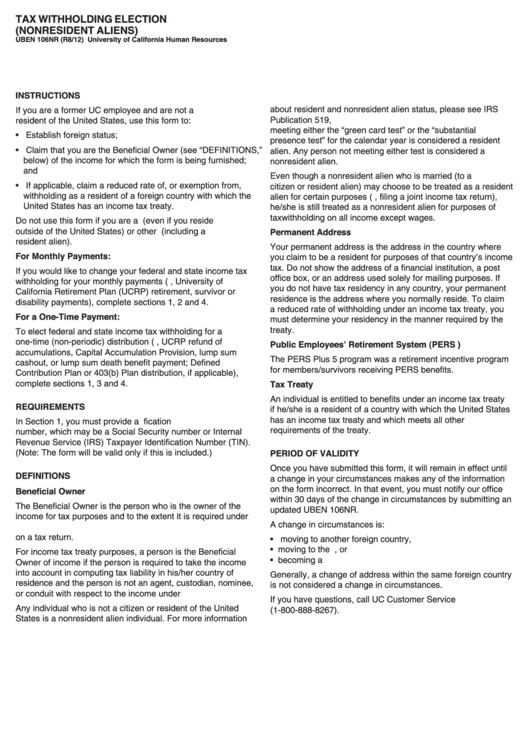

TAX WITHHOLDING ELECTION

(NONRESIDENT ALIENS)

UBEN 106NR (R8/12) University of California Human Resources

INSTRUCTIONS

about resident and nonresident alien status, please see IRS

If you are a former UC employee and are not a U.S. citizen or a

Publication 519, U.S. Tax Guide for Aliens. An alien individual

resident of the United States, use this form to:

meeting either the “green card test” or the “substantial

• Establish foreign status;

presence test” for the calendar year is considered a resident

• Claim that you are the Beneficial Owner (see “DEFINITIONS,”

alien. Any person not meeting either test is considered a

below) of the income for which the form is being furnished;

nonresident alien.

and

Even though a nonresident alien who is married (to a U.S.

• If applicable, claim a reduced rate of, or exemption from,

citizen or resident alien) may choose to be treated as a resident

withholding as a resident of a foreign country with which the

alien for certain purposes (e.g., filing a joint income tax return),

United States has an income tax treaty.

he/she is still treated as a nonresident alien for purposes of

taxwithholding on all income except wages.

Do not use this form if you are a U.S. citizen (even if you reside

Permanent Address

outside of the United States) or other U.S. person (including a

resident alien).

Your permanent address is the address in the country where

For Monthly Payments:

you claim to be a resident for purposes of that country’s income

tax. Do not show the address of a financial institution, a post

If you would like to change your federal and state income tax

office box, or an address used solely for mailing purposes. If

withholding for your monthly payments (e.g., University of

you do not have tax residency in any country, your permanent

California Retirement Plan (UCRP) retirement, survivor or

residence is the address where you normally reside. To claim

disability payments), complete sections 1, 2 and 4.

a reduced rate of withholding under an income tax treaty, you

For a One-Time Payment:

must determine your residency in the manner required by the

treaty.

To elect federal and state income tax withholding for a

one-time (non-periodic) distribution (e.g., UCRP refund of

Public Employees’ Retirement System (PERS )

accumulations, Capital Accumulation Provision, lump sum

The PERS Plus 5 program was a retirement incentive program

cashout, or lump sum death benefit payment; Defined

for members/survivors receiving PERS benefits.

Contribution Plan or 403(b) Plan distribution, if applicable),

Tax Treaty

complete sections 1, 3 and 4.

An individual is entitled to benefits under an income tax treaty

REQUIREMENTS

if he/she is a resident of a country with which the United States

has an income tax treaty and which meets all other

In Section 1, you must provide a U.S. taxpayer identification

requirements of the treaty.

number, which may be a Social Security number or Internal

Revenue Service (IRS) Taxpayer Identification Number (TIN).

PERIOD OF VALIDITY

(Note: The form will be valid only if this is included.)

Once you have submitted this form, it will remain in effect until

DEFINITIONS

a change in your circumstances makes any of the information

on the form incorrect. In that event, you must notify our office

Beneficial Owner

within 30 days of the change in circumstances by submitting an

The Beneficial Owner is the person who is the owner of the

updated UBEN 106NR.

income for tax purposes and to the extent it is required under

A change in circumstances is:

U.S. tax principles to include the amount paid in gross income

on a tax return.

• moving to another foreign country,

• moving to the U.S., or

For income tax treaty purposes, a person is the Beneficial

• becoming a U.S. citizen or resident.

Owner of income if the person is required to take the income

into account in computing tax liability in his/her country of

Generally, a change of address within the same foreign country

residence and the person is not an agent, custodian, nominee,

is not considered a change in circumstances.

or conduit with respect to the income under U.S. tax principles.

If you have questions, call UC Customer Service

Any individual who is not a citizen or resident of the United

(1-800-888-8267).

States is a nonresident alien individual. For more information

1

1 2

2 3

3