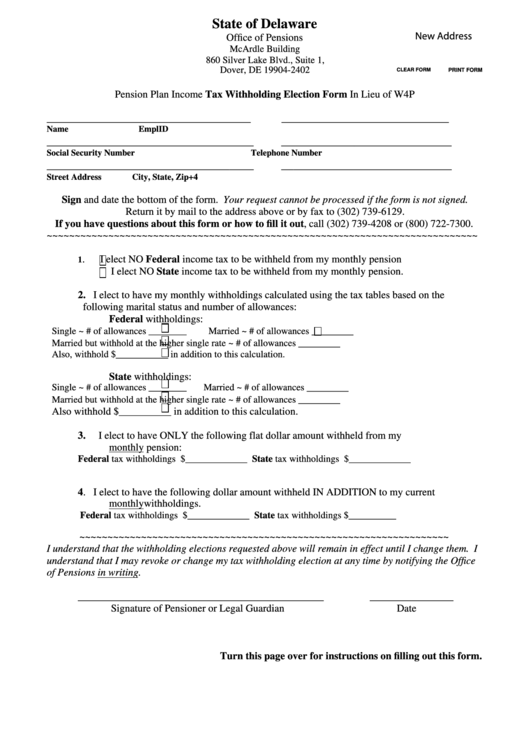

State of Delaware

New Address

Office of Pensions

McArdle Building

860 Silver Lake Blvd., Suite 1,

Dover, DE 19904-2402

PRINT FORM

CLEAR FORM

Pension Plan Income Tax Withholding Election Form In Lieu of W4P

_______________________________________

________________________________

Name

EmplID

__________________________________

____________________________

Social Security Number

Telephone Number

__________________________________

____________________________

Street Address

City, State, Zip+4

Sign and date the bottom of the form. Your request cannot be processed if the form is not signed.

Return it by mail to the address above or by fax to (302) 739-6129.

If you have questions about this form or how to fill it out, call (302) 739-4208 or (800) 722-7300.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

.

I elect NO Federal income tax to be withheld from my monthly pension

1

I elect NO State income tax to be withheld from my monthly pension.

2.

I elect to have my monthly withholdings calculated using the tax tables based on the

following marital status and number of allowances:

Federal withholdings:

________

Single ~ # of allowances ________

Married ~ # of allowances

________

Married but withhold at the higher single rate ~ # of allowances

Also, withhold $___________ in addition to this calculation.

State withholdings:

________

Single ~ # of allowances ________

Married ~ # of allowances

________

Married but withhold at the higher single rate ~ # of allowances

Also withhold $__________ in addition to this calculation.

3.

I elect to have ONLY the following flat dollar amount withheld from my

monthly pension:

Federal tax withholdings $_____________

State tax withholdings $_____________

4.

I elect to have the following dollar amount withheld IN ADDITION to my current

monthly withholdings.

Federal tax withholdings $_____________

State tax withholdings $__________

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I understand that the withholding elections requested above will remain in effect until I change them. I

understand that I may revoke or change my tax withholding election at any time by notifying the Office

of Pensions in writing.

_______________________________________________

________________

Signature of Pensioner or Legal Guardian

Date

Turn this page over for instructions on filling out this form.

1

1 2

2