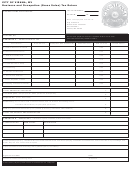

Compensation Tax Return Form - City Of La Grange Kentucky Page 2

ADVERTISEMENT

INSTRUCTIONS

Line 1. TOTAL COMPENSATION PAID IN CITY

Total Compensation is defined as wages or salaries paid or payable by an employer for services performed by an employee, which

are required to be reported for federal income tax purposes and adjusted as follows:

(a) Include any amounts contributed by an employee to any retirement, profit sharing, or deferred compensation plan, which are

deferred for federal income tax purposes under a salary reduction agreement or similar arrangement, including but not limited to salary

reduction arrangements under Section 401(a), 401(k), 402(e), 403(a), 403(b), 408, 414(h), or 457 of the Internal Revenue Code; and

(b) Include any amounts contributed by an employee to any welfare benefit, fringe benefit, or other benefit plan made by salary

reduction or other payment method which permits employees to elect to reduce federal taxable compensation under the Internal

Revenue Code, including but not limited to Sections 125 and 132 of the Internal Revenue Code.

Line 2. AMOUNT OF CITY OF LA GRANGE COMPENSATION TAX DUE

Round to Nearest $

A. Total Compensation Paid in City (Line 1)

B. Rate

X .01

C. Tax Amount* (Enter this amount on Line 2)

Line 3. AMUSEMENT GAME MACHINE LICENSE. $10.00 per machine. Attach list including location of games:

A. Do you own the Amusement game machines? Y or N

B. If NO, then list the name, address and telephone number of the owners.

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

Line 4. OCCUPATIONS FEE. All persons or businesses engaged in the occupations listed below shall pay the following fees before

the first day of the calendar year in which the activity shall be performed, or before the showing of the event in the case of

CARNIVALS and CIRCUSES. If licensee is engaged in more than one (1) activity in one business entity, the highest minimum

license fee shall apply. Minimum fees set forth below will not be reduced because the business covered by one engaged in the practice

at some time subsequent to January 1 of the taxable year.

CARNIVALS regardless of local sponsorship, per week $500.00 (before showing)

CIRCUSES, regardless of local sponsorship, per week $500.00 (before showing)

CITY DIRECTORY SALES, twelve (12) free copies of city directory and $50.00

DOOR-TO-DOOR SALESMEN, whether itinerant or not, $100.00 each salesman, yearly

NURSERYMEN OR FARM WORKERS, ITINERANT, yearly $25.00 each nurseryman or farm worker

PEDDLERS:

(1) Produce grown or produced in the county -- Exempt

(2) General peddlers, yearly $50.00

(3) Peddlers participating in festivals sponsored by Exempt organizations defined as exempt under Section 1 – Exempt

TAXICABS AND LIMOUSINES, certified by the Department of Vehicle Regulation to operate in the city, $30 per taxicab or

limousine per year.

Line 5. SUB-TOTAL. Lines 2 through 4 added.

Line 6. PENALTY. If the total tax is not remitted to the City of La Grange by the due date, there is a minimum penalty of $25.00 or

5% of the tax due for each month or a fraction thereof. The penalty shall not exceed 25% of the total tax due.

Line 7. INTEREST. If the total tax due is not remitted to the City of La Grange by the due date, the entity shall pay in addition to the

penalty, an amount equal to twelve (12%) percent per year simple interest on the tax due from the time due until the tax is paid to the

City.

Line 8. TOTAL CITY OF LA GRANGE COMPENSATION TAX. Lines 5 through 7 added.

REMEMBER: IF YOU MADE PAYMENTS IN THE SUM OF $600 OR MORE TO ANY INDIVIDUAL (OTHER THAN AN

EMPLOYEE) FOR SERVICES RENDERED IN LA GRANGE, YOU ARE REQUIRED TO FILE IRS FORM 1099.

Revised 2-19-2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2