Solar Energy Equipment Tax Exemption City Of Alexandria

ADVERTISEMENT

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

SOLAR ENERGY

EQUIPMENT TAX EXEMPTION

City of Alexandria, Virginia

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

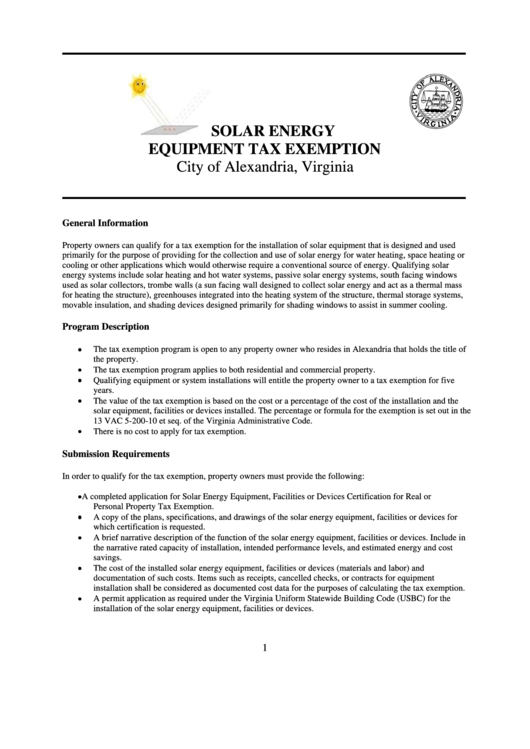

General Information

Property owners can qualify for a tax exemption for the installation of solar equipment that is designed and used

primarily for the purpose of providing for the collection and use of solar energy for water heating, space heating or

cooling or other applications which would otherwise require a conventional source of energy. Qualifying solar

energy systems include solar heating and hot water systems, passive solar energy systems, south facing windows

used as solar collectors, trombe walls (a sun facing wall designed to collect solar energy and act as a thermal mass

for heating the structure), greenhouses integrated into the heating system of the structure, thermal storage systems,

movable insulation, and shading devices designed primarily for shading windows to assist in summer cooling.

Program Description

The tax exemption program is open to any property owner who resides in Alexandria that holds the title of

the property.

The tax exemption program applies to both residential and commercial property.

Qualifying equipment or system installations will entitle the property owner to a tax exemption for five

years.

The value of the tax exemption is based on the cost or a percentage of the cost of the installation and the

solar equipment, facilities or devices installed. The percentage or formula for the exemption is set out in the

13 VAC 5-200-10 et seq. of the Virginia Administrative Code.

There is no cost to apply for tax exemption.

Submission Requirements

In order to qualify for the tax exemption, property owners must provide the following:

A completed application for Solar Energy Equipment, Facilities or Devices Certification for Real or

Personal Property Tax Exemption.

A copy of the plans, specifications, and drawings of the solar energy equipment, facilities or devices for

which certification is requested.

A brief narrative description of the function of the solar energy equipment, facilities or devices. Include in

the narrative rated capacity of installation, intended performance levels, and estimated energy and cost

savings.

The cost of the installed solar energy equipment, facilities or devices (materials and labor) and

documentation of such costs. Items such as receipts, cancelled checks, or contracts for equipment

installation shall be considered as documented cost data for the purposes of calculating the tax exemption.

A permit application as required under the Virginia Uniform Statewide Building Code (USBC) for the

installation of the solar energy equipment, facilities or devices.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3