Solar Energy Equipment Tax Exemption City Of Alexandria Page 3

ADVERTISEMENT

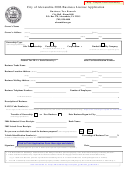

Solar Energy Equipment, Facilities or Devices

Certification for Real or Personal Property

Tax Exemption

Pursuant to § 58.1-3661 of the Code of Virginia

Pursuant to § 58.1-3661 of the Code of Virginia, ______________________________________

Applicant’s Name

hereby makes application for certification for tax exemption of solar energy equipment, facilities,

or devices located at: ____________________________________________________________

Street Address

________________________________________________________________________________

City

State

Zip

and hereby submits the following information and documents:

Owner’s Name: ________________________________________________________________

Owner’s Phone: ________________________________________________________________

Tax Map ID: ___________________________________________________________________

1. A copy of the plans, specifications, and drawings of the solar energy equipment,

facilities, or devices for which certification is requested.

2. A brief narrative description of the function of the solar energy equipment, facilities, or

devices.

3. The cost of the installed solar energy equipment, facilities, or devices (materials and

labor) and documentation of such costs.

Total costs of installed solar energy equipment, facilities, or devices: $ ____________________

_________________________________

___________________

Applicant’s Signature

Date

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

This section for City Use Only

This is to certify that the solar energy equipment, facility or device described herein complies with the criteria set forth in 13

VAC 5-200-10 et.seq . of the Virginia Administrative Code. The listed equipment has been inspected for compliance with the

Uniform Statewide Building Code and has been installed for the purpose for which the equipment is intended.

_________________________________________________________

______________________

Department of Code Administration

Date

Authorized Signature

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Once certified by Code Administration as stated above, this application will be forwarded to Real Estate Assessments for review

of the cost associated with the installation and equipment, and the calculation of the value of tax credit pursuant to § 58.1-3661 of

the Code of Virginia and the Code of the City of Alexandria. Real Estate Assessments will issue a separate letter to the applicant.

This letter will explain the calculation of the value of the tax credit and the time period for which the credit will apply. Please

contact Real Estate at 703.746.4646 if you have questions about this part of the process.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3