Travel Expense Claim For Non Bc Government

ADVERTISEMENT

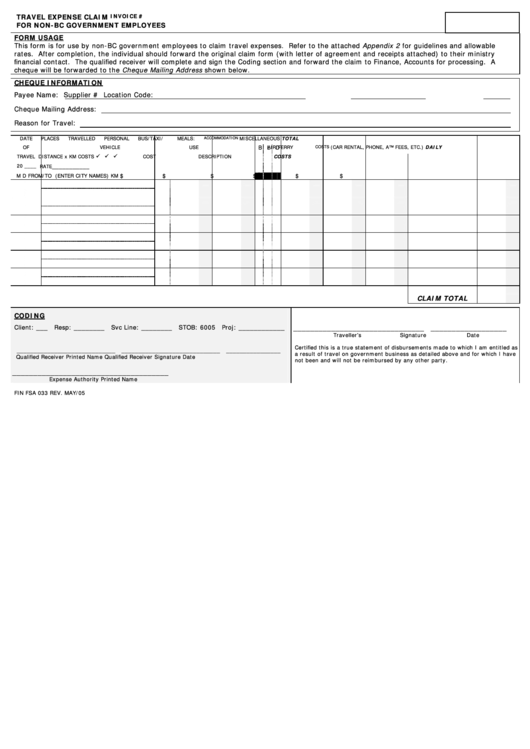

TRAVEL EXPENSE CLAIM

INVOICE #

FOR NON-BC GOVERNMENT EMPLOYEES

FORM USAGE

This form is for use by non-BC government employees to claim travel expenses. Refer to the attached Appendix 2 for guidelines and allowable

rates. After completion, the individual should forward the original claim form (with letter of agreement and receipts attached) to their ministry

financial contact. The qualified receiver will complete and sign the Coding section and forward the claim to Finance, Accounts for processing. A

cheque will be forwarded to the Cheque Mailing Address shown below.

CHEQUE INFORMATION

Payee Name:

Supplier #

Location Code:

Cheque Mailing Address:

Reason for Travel:

DATE

PLACES TRAVELLED

PERSONAL

BUS/TAXI/

MEALS:

ACCOMMODATION

MISCELLANEOUS

TOTAL

OF

VEHICLE USE

AIR/FERRY

B L

D

COSTS

(CAR RENTAL, PHONE, ATM FEES, ETC.)

DAILY

TRAVEL

DISTANCE x KM

COSTS

COST

DESCRIPTION

COSTS

20 ____

___________

RATE

M

D

FROM/TO (ENTER CITY NAMES)

KM

$

$

$

$

$

$

CLAIM TOTAL

CODING

Client: ___

Resp: ________

Svc Line: ________

STOB: 6005

Proj: ____________

_______________________________

__________________

Traveller’s Signature

Date

Certified this is a true statement of disbursements made to which I am entitled as

_____________________________

_____________________________

________________

a result of travel on government business as detailed above and for which I have

Qualified Receiver Printed Name

Qualified Receiver Signature

Date

not been and will not be reimbursed by any other party.

_____________________________________

Expense Authority Printed Name

FIN FSA 033 REV. MAY/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1