Form W-4p - State Withholding Election

ADVERTISEMENT

Account Number

1

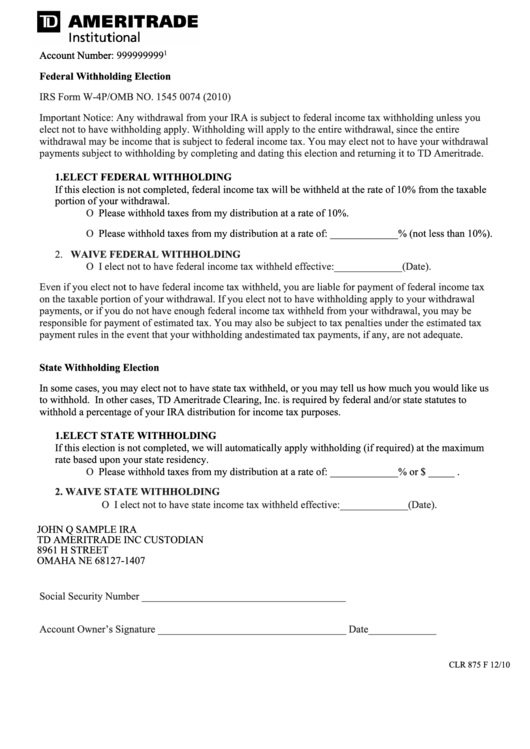

Account Number: 999999999

Federal Withholding Election

IRS Form W-4P/OMB NO. 1545 0074 (2010)

Important Notice: Any withdrawal from your IRA is subject to federal income tax withholding unless you

elect not to have withholding apply. Withholding will apply to the entire withdrawal, since the entire

withdrawal may be income that is subject to federal income tax. You may elect not to have your withdrawal

payments subject to withholding by completing and dating this election and returning it to TD Ameritrade.

1. ELECT FEDERAL WITHHOLDING

If this election is not completed, federal income tax will be withheld at the rate of 10% from the taxable

portion of your withdrawal.

O

Please withhold taxes from my distribution at a rate of 10%.

O

Please withhold taxes from my distribution at a rate of: _____________% (not less than 10%).

2. WAIVE FEDERAL WITHHOLDING

O I elect not to have federal income tax withheld effective:_____________(Date).

Even if you elect

not

to have federal income tax withheld, you are liable for payment of federal income tax

on the taxable portion of

your

withdrawal. If you elect not to have withholding apply to your withdrawal

payments, or if you do not have enough federal

income

tax withheld from your withdrawal, you may be

responsible for payment of estimated tax. You may also be subject to tax penalties under the estimated tax

payment rules in the event that your withholding and estimated tax payments, if any, are not

adequate.

State Withholding Election

In some cases, you may elect not to have state tax withheld, or you may tell us how much you would like us

to withhold. In other cases, TD Ameritrade Clearing, Inc. is required by federal and/or state statutes to

withhold a percentage of your IRA distribution for income tax purposes.

1. ELECT STATE WITHHOLDING

If this election is not completed, we will automatically apply withholding (if required) at the maximum

rate based upon your state residency.

O

Please withhold taxes from my distribution at a rate of: _____________% or $ _____ .

2. WAIVE STATE WITHHOLDING

O I elect not to have state income tax withheld effective:_____________(Date).

JOHN Q SAMPLE IRA

TD AMERITRADE INC CUSTODIAN

8961 H STREET

OMAHA NE 68127-1407

Social Security Number _______________________________________

Account Owner’s Signature ____________________________________ Date_____________

CLR 875 F 12/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1