Request For Safe Harbor Hardship Withdrawal

ADVERTISEMENT

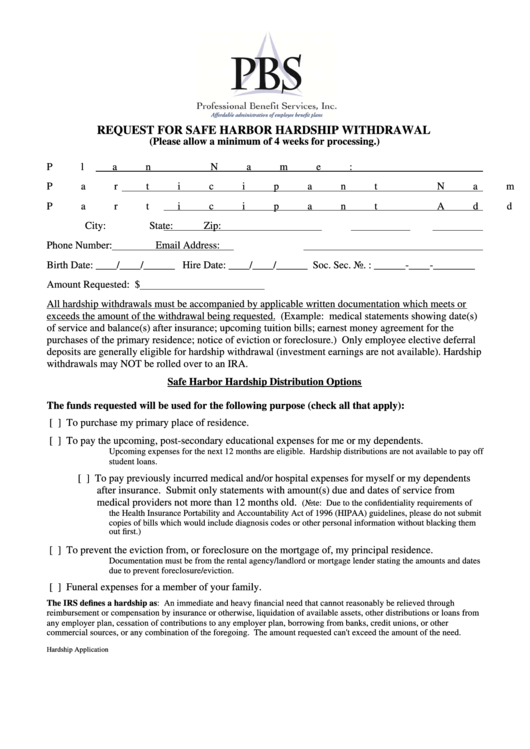

REQUEST FOR SAFE HARBOR HARDSHIP WITHDRAWAL

(Please allow a minimum of 4 weeks for processing.)

Plan Name:

Participant Name:

Participant Address: Street:

City:

State:

Zip:

Phone Number:

Email Address:

Birth Date: ____/____/______ Hire Date: ____/____/______ Soc. Sec. No. : ______-____-________

Amount Requested: $

All hardship withdrawals must be accompanied by applicable written documentation which meets or

exceeds the amount of the withdrawal being requested. (Example: medical statements showing date(s)

of service and balance(s) after insurance; upcoming tuition bills; earnest money agreement for the

purchases of the primary residence; notice of eviction or foreclosure.) Only employee elective deferral

deposits are generally eligible for hardship withdrawal (investment earnings are not available). Hardship

withdrawals may NOT be rolled over to an IRA.

Safe Harbor Hardship Distribution Options

The funds requested will be used for the following purpose (check all that apply):

[ ] To purchase my primary place of residence.

[ ] To pay the upcoming, post-secondary educational expenses for me or my dependents.

Upcoming expenses for the next 12 months are eligible. Hardship distributions are not available to pay off

student loans.

[ ] To pay previously incurred medical and/or hospital expenses for myself or my dependents

after insurance. Submit only statements with amount(s) due and dates of service from

medical providers not more than 12 months old.

(Note: Due to the confidentiality requirements of

the Health Insurance Portability and Accountability Act of 1996 (HIPAA) guidelines, please do not submit

copies of bills which would include diagnosis codes or other personal information without blacking them

out first.)

[ ] To prevent the eviction from, or foreclosure on the mortgage of, my principal residence.

Documentation must be from the rental agency/landlord or mortgage lender stating the amounts and dates

due to prevent foreclosure/eviction.

[ ] Funeral expenses for a member of your family.

The IRS defines a hardship as: An immediate and heavy financial need that cannot reasonably be relieved through

reimbursement or compensation by insurance or otherwise, liquidation of available assets, other distributions or loans from

any employer plan, cessation of contributions to any employer plan, borrowing from banks, credit unions, or other

commercial sources, or any combination of the foregoing. The amount requested can't exceed the amount of the need.

Hardship Application 2012.doc

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2