Hospitality Tax Form Kingstree Sc

ADVERTISEMENT

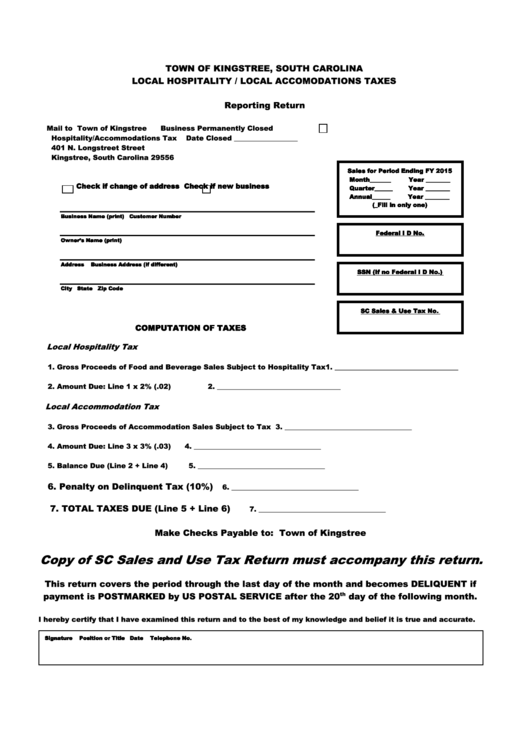

TOWN OF KINGSTREE, SOUTH CAROLINA

LOCAL HOSPITALITY / LOCAL ACCOMODATIONS TAXES

Reporting Return

Mail to

Town of Kingstree

Business Permanently Closed

Hospitality/Accommodations Tax

Date Closed __________________

401 N. Longstreet Street

Kingstree, South Carolina 29556

Sales for Period Ending FY 2015

Month_______

Year ________

Check if change of address

Check if new business

Quarter______

Year ________

Annual______

Year ________

(_Fill in only one)

Business Name (print)

Customer Number

Federal I D No.

Owner’s Name (print)

Address

Business Address (if different)

SSN (If no Federal I D No.)

City

State

Zip Code

SC Sales & Use Tax No.

COMPUTATION OF TAXES

Local Hospitality Tax

1. Gross Proceeds of Food and Beverage Sales Subject to Hospitality Tax

1. ___________________________________

2. Amount Due: Line 1 x 2% (.02)

2. ___________________________________

Local Accommodation Tax

3. Gross Proceeds of Accommodation Sales Subject to Tax

3. ____________________________________

4. Amount Due: Line 3 x 3% (.03)

4. ____________________________________

5. Balance Due (Line 2 + Line 4)

5. ____________________________________

6. Penalty on Delinquent Tax (10%)

6. ____________________________________

7. TOTAL TAXES DUE (Line 5 + Line 6)

7. ____________________________________

Make Checks Payable to: Town of Kingstree

Copy of SC Sales and Use Tax Return must accompany this return.

This return covers the period through the last day of the month and becomes DELIQUENT if

payment is POSTMARKED by US POSTAL SERVICE after the 20

day of the following month.

th

I hereby certify that I have examined this return and to the best of my knowledge and belief it is true and accurate.

Signature

Position or Title

Date

Telephone No.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1