Mortgage Tax Credit Affidavit

Download a blank fillable Mortgage Tax Credit Affidavit in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Mortgage Tax Credit Affidavit with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

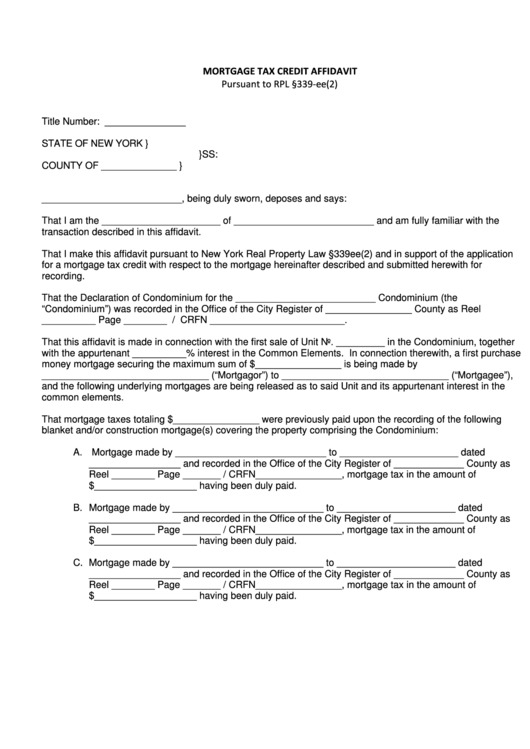

MORTGAGE TAX CREDIT AFFIDAVIT

Pursuant to RPL §339-ee(2)

Title Number: _______________

STATE OF NEW YORK

}

}SS:

COUNTY OF ______________

}

__________________________, being duly sworn, deposes and says:

That I am the ______________________ of __________________________ and am fully familiar with the

transaction described in this affidavit.

That I make this affidavit pursuant to New York Real Property Law §339ee(2) and in support of the application

for a mortgage tax credit with respect to the mortgage hereinafter described and submitted herewith for

recording.

That the Declaration of Condominium for the __________________________ Condominium (the

“Condominium”) was recorded in the Office of the City Register of ________________ County as Reel

__________ Page ________ / CRFN _________________________.

That this affidavit is made in connection with the first sale of Unit No. _________ in the Condominium, together

with the appurtenant __________% interest in the Common Elements. In connection therewith, a first purchase

money mortgage securing the maximum sum of $________________ is being made by

_______________________________ (“Mortgagor”) to _______________________________ (“Mortgagee”),

and the following underlying mortgages are being released as to said Unit and its appurtenant interest in the

common elements.

That mortgage taxes totaling $________________ were previously paid upon the recording of the following

blanket and/or construction mortgage(s) covering the property comprising the Condominium:

A. Mortgage made by ____________________________ to ______________________ dated

_________________ and recorded in the Office of the City Register of _____________ County as

Reel ________ Page _______ / CRFN________________, mortgage tax in the amount of

$___________________ having been duly paid.

B. Mortgage made by ____________________________ to ______________________ dated

_________________ and recorded in the Office of the City Register of _____________ County as

Reel ________ Page _______ / CRFN________________, mortgage tax in the amount of

$___________________ having been duly paid.

C. Mortgage made by ____________________________ to ______________________ dated

_________________ and recorded in the Office of the City Register of _____________ County as

Reel ________ Page _______ / CRFN________________, mortgage tax in the amount of

$___________________ having been duly paid.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3