Realty Transfer And Mortgage Tax Return

ADVERTISEMENT

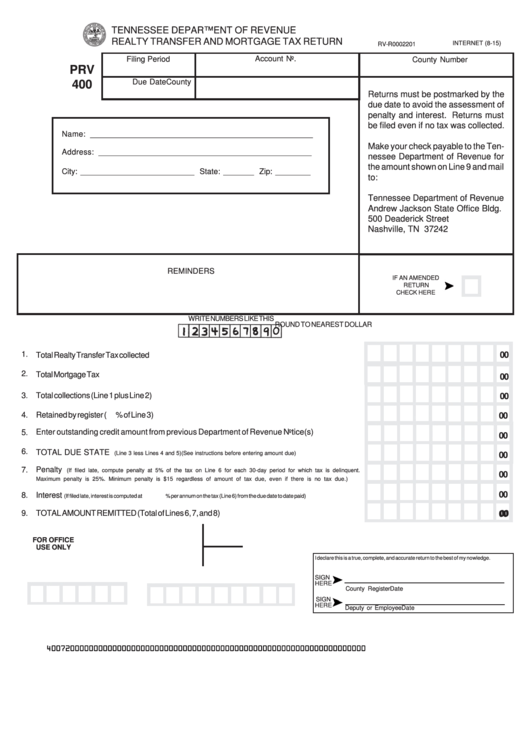

TENNESSEE DEPARTMENT OF REVENUE

REALTY TRANSFER AND MORTGAGE TAX RETURN

INTERNET (8-15)

RV-R0002201

Filing Period

Account No.

County Number

PRV

Due Date

County

400

Returns must be postmarked by the

due date to avoid the assessment of

penalty and interest. Returns must

be filed even if no tax was collected.

Name: _________________________________________________

Make your check payable to the Ten-

Address: _______________________________________________

nessee Department of Revenue for

the amount shown on Line 9 and mail

City: __________________________ State: _______ Zip: ________

to:

Tennessee Department of Revenue

Andrew Jackson State Office Bldg.

500 Deaderick Street

Nashville, TN 37242

REMINDERS

IF AN AMENDED

1.

Please read instructions on reverse side before preparing this return.

RETURN

2.

Maintain adequate records to support the return.

CHECK HERE

3.

Sign and date return in the signature box below.

WRITE NUMBERS LIKE THIS

ROUND TO NEAREST DOLLAR

1.

00

Total Realty Transfer Tax collected ......................................................................................................

2.

Total Mortgage Tax collected..................................................................................................................

00

Total collections (Line 1 plus Line 2)....................................................................................................

3.

00

4.

Retained by register ( % of Line 3)....................................................................................................

00

Enter outstanding credit amount from previous Department of Revenue Notice(s)...................

5.

00

6.

TOTAL DUE STATE

(Line 3 less Lines 4 and 5)(See instructions before entering amount due) ...........................................

00

Penalty

7.

(If filed late, compute penalty at 5% of the tax on Line 6 for each 30-day period for which tax is delinquent.

00

Maximum penalty is 25%. Minimum penalty is $15 regardless of amount of tax due, even if there is no tax due.)..........

00

8.

Interest

...............................

(If filed late, interest is computed at

% per annum on the tax (Line 6) from the due date to date paid)

00

9.

TOTAL AMOUNT REMITTED (Total of Lines 6, 7, and 8)...................................................................

00

FOR OFFICE

USE ONLY

I declare this is a true, complete, and accurate return to the best of my nowledge.

SIGN

HERE

County Register

Date

SIGN

HERE

Deputy or Employee

Date

40072000000000000000000000000000000000000000000000000000000000000000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2