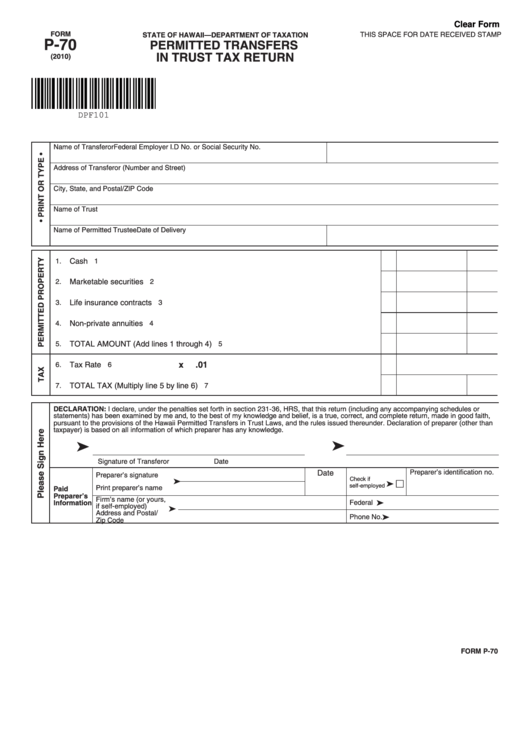

Clear Form

FORM

STATE OF HAWAII—DEPARTMENT OF TAXATION

THIS SPACE FOR DATE RECEIVED STAMP

P-70

PERMITTED TRANSFERS

IN TRUST TAX RETURN

(2010)

DPF101

Name of Transferor

Federal Employer I.D No. or Social Security No.

Address of Transferor (Number and Street)

City, State, and Postal/ZIP Code

Name of Trust

Name of Permitted Trustee

Date of Delivery

Cash ...................................................................................................................................

1.

1

Marketable securities ..........................................................................................................

2.

2

Life insurance contracts ......................................................................................................

3.

3

Non-private annuities ..........................................................................................................

4.

4

TOTAL AMOUNT (Add lines 1 through 4) ...........................................................................

5.

5

x

.01

6.

Tax Rate .............................................................................................................................

6

TOTAL TAX (Multiply line 5 by line 6) ..................................................................................

7.

7

DECLARATION: I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or

statements) has been examined by me and, to the best of my knowledge and belief, is a true, correct, and complete return, made in good faith,

pursuant to the provisions of the Hawaii Permitted Transfers in Trust Laws, and the rules issued thereunder. Declaration of preparer (other than

taxpayer) is based on all information of which preparer has any knowledge.

Signature of Transferor

Date

Date

Preparer’s identification no.

Preparer’s signature

Check if

self-employed

Print preparer’s name

Paid

Preparer’s

Firm’s name (or yours,

Information

Federal E.I. No.

if self-employed)

Address and Postal/

Phone No.

Zip Code

FORM P-70

1

1