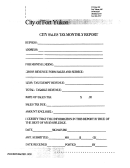

Refund Claim Form - City Of Fort Collins Page 2

ADVERTISEMENT

INSTRUCTIONS

1. The claim must be accompanied by supporting documentation* of sales/use tax paid. Please include copies of

sales invoices, receipts, etc., or other documentation that proves what type of tax was paid.

2. The claim should be signed by the taxpayer, if possible. Whenever it is necessary to have the claim executed by

an attorney or agent, on behalf of the taxpayer, an authenticated copy of the document specifically authorizing

such an agent or attorney to sign the claim on behalf of the taxpayer should accompany the claim.

3. Where the taxpayer is a corporation, the claim shall be signed with the corporate name, followed by the

signature and title of the officer having authority to sign for the corporation.

4. Any false statement made by the applicant for sales/use tax refund is punishable on conviction by a maximum

fine of $300 or a minimum sentence of ninety (90) days or both.

* If the claim is for tax paid on a vehicle, the following must be included:

1. Copy of Colorado driver’s license showing current address.

2. Copy of registration on the vehicle.

3. Copy of the sales invoice.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2