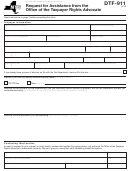

Request for Help From the Office of the Taxpayer Advocate - Instructions to Form DOF-911

Page 2

SPECIFIC INSTRUCTIONS

your information

with Personal Income Tax or Sales Tax, con-

tact the New York State Office of the Taxpayer

Rights Advocate.

e-mail address

We may contact you by e-mail if we are not

tax periods

able to reach you by telephone. We won’t use

Enter the quarterly, annual or other tax peri-

your e-mail address to discuss the specifics of

od(s) that relates to this request.

your case.

describe the tax problem

social security number

you are having

Enter your taxpayer identification number on

Enter any detailed information about your tax

the form. If you are an individual, please put

problem that you are having. If you have writ-

in your social security number. If you are not

ten to or talked to a Department of Finance

an individual (e.g., a partnership, corporation,

employee, please list his or her name and the

or self- employed), please list your EIN.

contact information you have for that person

someone helping you

(such as a telephone number or e-mail

address.) If you have any case number or

other information about your case, also

rent freeze taxpayer (scrie/drie)

include that.

If you are a tenant requesting help with

SCRIE/DRIE (Rent Freeze)

and you have

chosen a tenant representative, please enter

privacy notification - The Federal Privacy Act of 1974, as

the name of that person and his or her contact

amended, requires agencies requesting Social Security

Numbers to inform individuals from whom they seek this infor-

information.

mation as to whether compliance with the request is voluntary

or mandatory, why the request is being made and how the

business contact person

information will be used. The disclosure of Social Security

If a business entity is filing this form, enter the

Numbers for applicants and income-earning occupants is

name of the person to contact about the

mandatory and is required by section 11-102.1 of the

Administrative Code of the City of New York. Such numbers

request. This may be a corporate officer sign-

disclosed on any reports or returns are requested for tax

ing the request or another person authorized

administration purposes and will be used to facilitate the pro-

to discuss the matter.

cessing of reports and to establish and maintain a uniform

system for identifying taxpayers who are or may be subject to

power of attorney

taxes administered and collected by the Department of

Finance. Such numbers may also be disclosed as part of

If you are inquiring about a tax problem OTHER

information contained in the taxpayer’s return to another

THAN Rent Freeze and you have chosen a

department, person, agency or entity as may be required by

representative to act on your behalf, you must

law, or if the applicant or income-earning occupants gives

complete a Power of Attorney Form POA-1.

written authorization to the Department of Finance.

about your nyc tax problem

tax type

Enter the type of tax that you are having a

problem with: Property, Business or Other.

Please note that if you are having a problem

1

1 2

2 3

3 4

4